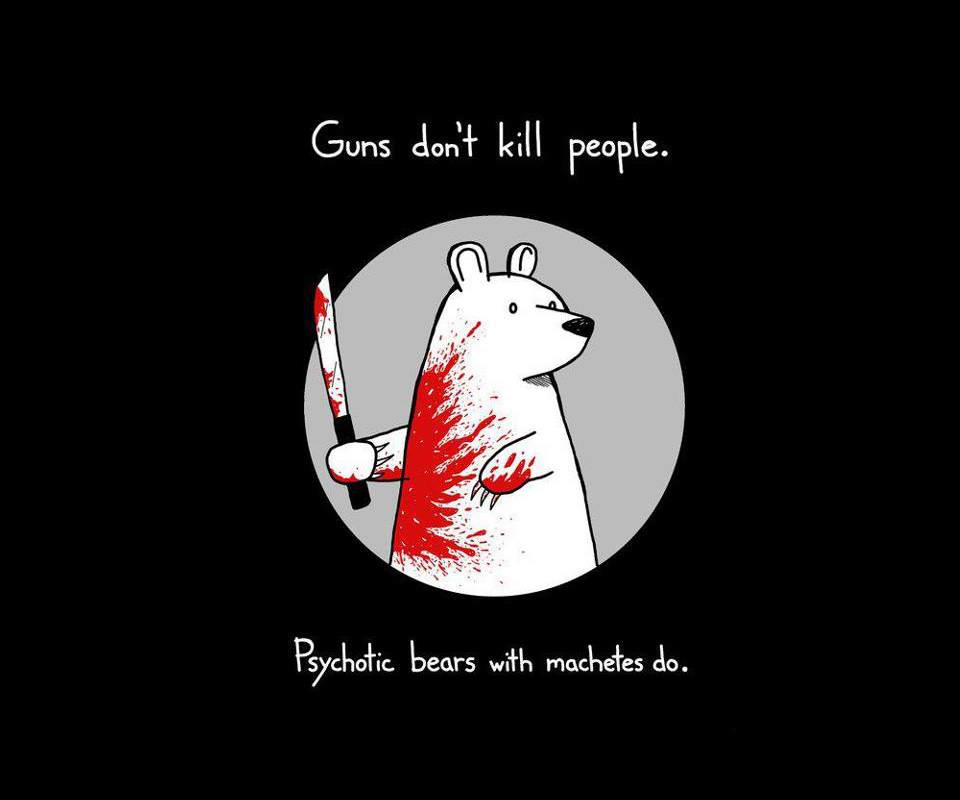

The bear camp has been eviscerated by its own bear machete. The “sky is falling” camp has imploded under its own weight. The imminent apocalypse never came, the flight to safety (Treasury things) is collapsing, as the last of the bond bulls have been impaled.

Being neither a perm bear or bull, but just a guy that thinks conventional wisdom is always wrong, I see the tape going much higher, even after what we have seen lately. Will a pause come? Of course, but a pullback always comes after a move.

The euro rallied off the lows like I thought, and broke above the 200 day moving average last week. Bonds are collapsing like I thought and $TLT has been a great short for us from the 126 level just a week ago.

China will ease, and build more bridges to nowhere and as it turns out, it is NEVER as bad as the pundits say. But be ready though, all of them will continue to tell how to trade the market next week, even though they missed everything. They too, can’t help themselves. Oh to be a macro perma bear.

Draghi has “saved” Europe for now, (0f course not), but perception is reality. Bernanke didn’t save the economy by printing like a drunken sailor last week, but the market loved it. Macro consensus doesn’t matter when attempting to make money from the market. You will most often be better served by going the other way. The bears were pushing on a string with all the negativity. Sometimes there’s just no one left to sell.

I expect a further melt up through the end of the year as visions of sugar plums and Bently’s hit the desks of all the non performing mutual funds and hedge funds. None of the hedgies are long enough, I talk to them, they don’t have enough long exposure, and they are worried. They were all waiting for the pullback that never came.

I’ve been waking up everyday for a few months now, praying for downgrades from analysts in the coal and material spaces. They unknowingly complied and some coal stocks have rallied 50% in the last week or so. $CLF was basically downgraded to zero, but the stock has run 13 points in the last ten trading days. As they say, analysts are useless in a good market and will kill you in a bad one.

Jim O’Neil at Goldman, the only guy in the room that sees things clearly in my opinion, says look at the New China, not the old China. Gone are the days of 12% growth, but everyone should do just fine absent that ridiculous anomaly. He loves emerging markets going forward and thinks India is done going down.

He invented the “BRICS” and now speaks about ‘MIST’ which is Mexico, Indonesia, South Korea and Turkey. He believes these four countries should not be considered “emerging” any longer. Many are up 20% year to date and will go higher.

Brazil continues to chip away with supply-side policy changes. On Thursday they announced steps

to try and lower energy costs as well as improving the tax environment.

On India he opines, ” As of this morning, the main Indian stock market is up nearly 20% for the year. There was a

particularly good move this morning, accelerating the rise of recent weeks, which occurred despite

all of India’s ‘disappointments’. Some of this was prompted by news that the authorities have finally

had the courage to raise fuel taxes and reduce the subsidy. This indicates that; a) they now are

prepared to do something about the growing fiscal deficit and b) they are capable of positive policy

change.”

The tape got too negative, I call it psychological capitulation. You want to quit, kind like the famous boxing match when Duran said “no mas”. But you give the pundits too much credit. The economy isn’t the market and pundits cant trade. Nothing personal, it’s just true.

If you would like to view performance and become a member email me at: upsidtrader@gmail. com or join here.