U.S. stocks stumbled to close out January as tech weakness and a historic commodity selloff overshadowed solid earnings and the announcement of Kevin Warsh as President Trump’s pick for Fed Chair. Markets remain caught between optimism over corporate profit growth and concerns about stretched valuations, AI capex sustainability, and whether this aging bull market can handle rate-hold reality.

For the week, the Dow fell 0.4%, the S&P 500 dropped 0.3%, and the Nasdaq dipped 0.2%. January ended with the S&P 500 up 1.4%, the Dow gaining 1.7%, and the Nasdaq advancing 1%. The Russell 2000 crushed it, surging 5% for the month.

Friday saw stocks close lower, capping a volatile final week of January. The S&P 500 fell 0.43% to 6,939.03, the Dow dropped 179 points or 0.36% to 48,892.47, and the Nasdaq underperformed with a 0.94% decline to 23,461.82. The VIX jumped to 17.44, up 3.32%, signaling increased caution.

Trump’s nomination of Kevin Warsh to replace Jerome Powell as Fed Chair initially spooked markets overnight, but stocks clawed back from session lows. Warsh, a former Fed Governor from 2006-2011, is viewed as hawkish on inflation but dovish on rates, creating uncertainty about the Fed’s path forward. The move sparked debate about Fed independence, though Warsh’s experience and credentials eased some concerns.

Tech remained under pressure all week. Microsoft’s disappointing cloud growth guidance on Thursday triggered a sector-wide selloff, with the software sector taking the brunt. AAPL gained modestly despite solid earnings, while TSLA bounced 3.3% Friday after getting hammered on Thursday. The Magnificent Seven are facing harsh scrutiny this earnings season—beats are being sold, and misses are punished harder than any quarter since 2000.

Earnings season is tracking solid but not spectacular. Of 133 S&P 500 companies reporting through Thursday, 74.4% beat expectations, slightly below the 78% four-quarter average. Q4 earnings are projected to grow 10.2% year over year, with full-year 2026 earnings expected to climb 15%.

The commodity markets stole the show on Friday with an epic reversal. Gold plunged 11.4% to $4,745, silver crashed 31.4% in its worst single-day drop in modern history, while copper, aluminum, and mining stocks were decimated. The Warsh Fed Chair pick triggered profit-taking after gold’s moonshot to above $5,300 earlier in the week and silver’s historic run past $100. Investors bet Warsh’s hawkish credentials could stabilize the dollar and reduce safe-haven demand. Oil held steady around $58, while Bitcoin dropped 1.7% to $81,448.

Economic data showed the Producer Price Index for December rose 0.5% month over month (vs. 0.3% expected), with the core PPI up 0.7% (vs. 0.3% expected). The hotter-than-expected wholesale inflation reading suggests the Fed may keep rates higher for longer, supporting Warsh’s likely cautious approach to cuts.

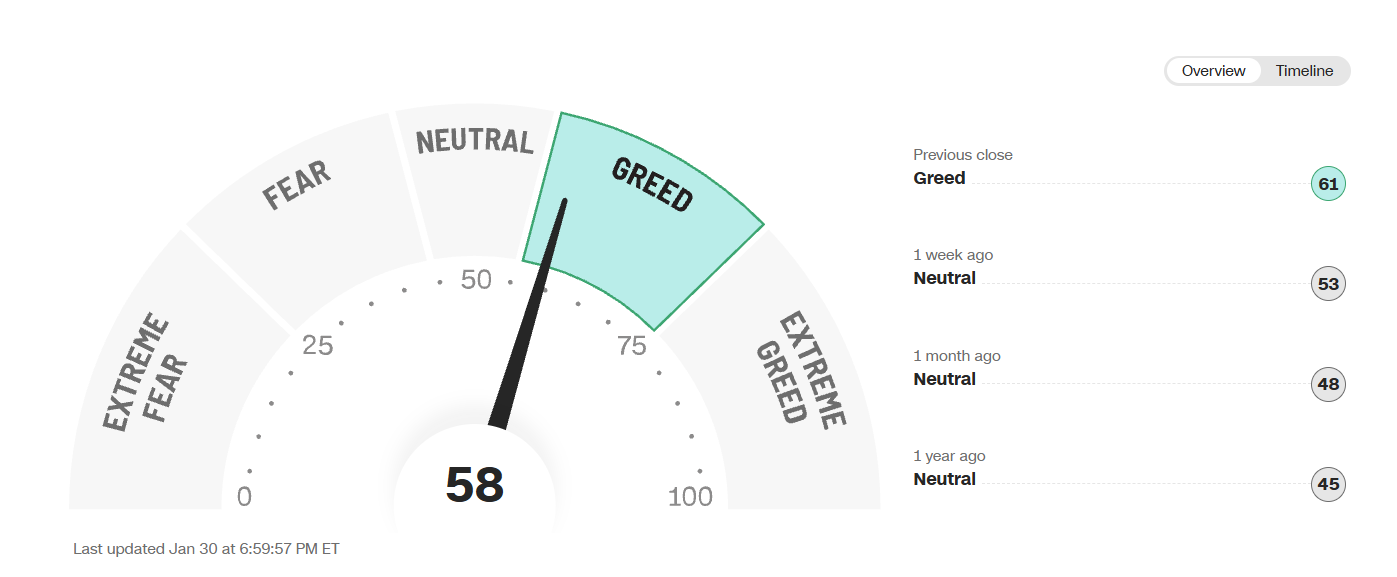

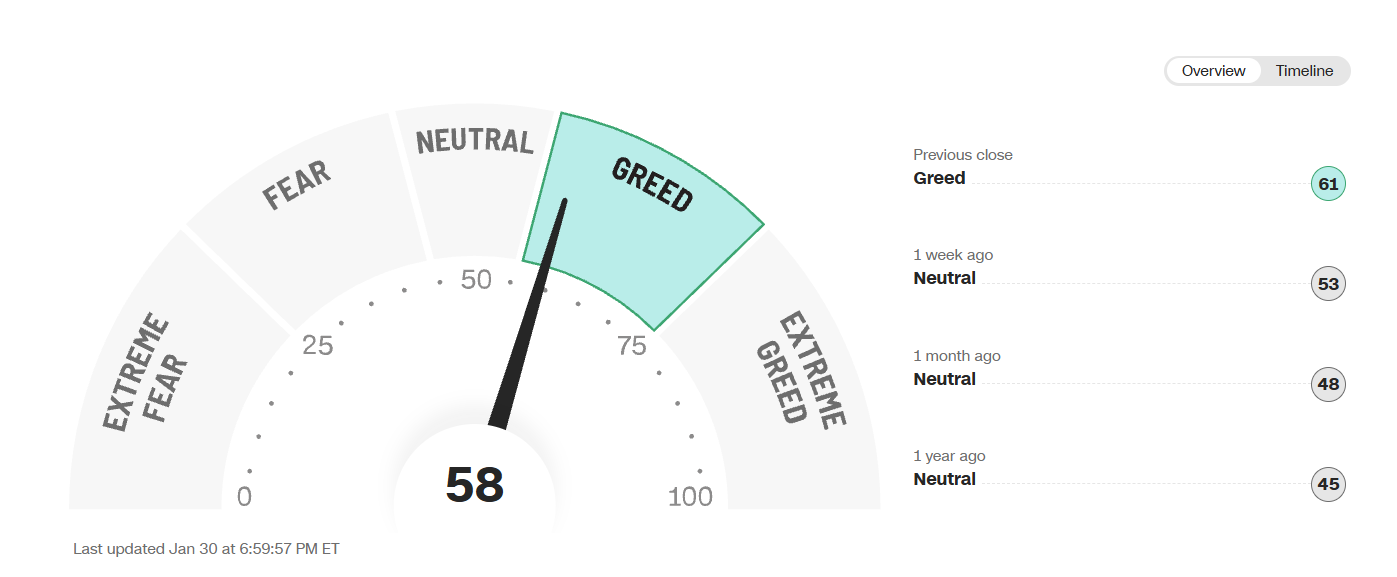

The Fear & Greed Index sits at 62 (Greed), though Friday’s action suggests confidence may be softening as we head into February.

THE WEEK AHEAD:

Next week brings a monster calendar with megacap earnings and critical jobs data that could define the market’s February trajectory.

EARNINGS SPOTLIGHT: Monday: Palantir (PLTR), Walt Disney (DIS), NXP Semiconductors (NXPI) Tuesday: AMD, Amgen (AMGN), Merck (MRK), Pfizer (PFE), PayPal (PYPL) Wednesday: Alphabet (GOOGL), AbbVie (ABBV), Qualcomm (QCOM) Thursday: Amazon (AMZN), Eli Lilly (LLY), Shell (SHEL) Friday: Philip Morris (PM), Toyota Motor (TM)

All eyes are on GOOGL and AMZN—the last two AI hyperscalers to report after Microsoft’s stumble. Investors will scrutinize cloud growth, AI cap-ex plans, and whether the massive infrastructure investments are translating into revenue. Consensus expects GOOGL to report Q4 earnings up 22% to $2.63/share on revenue of $111.4B, while AMZN is projected to earn $1.97/share on $211.3B revenue.

ECONOMIC DATA: Monday: ISM Manufacturing PMI (January) Tuesday: JOLTS Job Openings (December) Wednesday: ADP Employment Change, ISM Services PMI (January) Thursday: Initial Jobless Claims Friday: January Jobs Report—Nonfarm Payrolls expected +70K (vs. prior month’s revised figures)

The January jobs report on Friday will be pivotal. After data disruptions from the late-2025 government shutdown, this marks the first clean read on labor market health in months. The Fed cited stabilizing labor conditions this week when it paused rate cuts, so any weakness could shift expectations for 2026 policy.

KEY THEMES TO WATCH:

AI Capex Reckoning: Microsoft’s cloud miss has investors questioning whether AI infrastructure spending will justify near-term returns. GOOGL and AMZN guidance on 2026 capex (expected $89.8B and $144.1B, respectively) will be critical.

Earnings Season Harshness: This is the toughest market reaction to earnings since 2000. Even beats are getting sold if guidance disappoints. The bar is high, and tolerance for execution stumbles is zero.

Fed Path Clarity: Warsh won’t take over until May, but his hawkish reputation could anchor rate-cut expectations lower. The jobs report will inform whether markets price in two cuts or zero cuts for 2026.

Small-Cap Resurgence: The Russell 2000’s 5% January gain signals rotation underway. If big-cap tech continues to disappoint, small caps could extend their outperformance.

Commodity Reset: After the historic Friday selloff in gold and silver, watch whether dip-buyers emerge or if the “anti-fiat” trade is truly over. The metals had been pricing in dollar-debasement fears—Warsh’s pick suggests those fears may have been overblown.

Valuation Reality Check: The S&P 500 trades at elevated multiples (~21x forward earnings) heading into Year 4 of this bull market. With the Fed holding rates steady and corporate profit growth expected to grow by 15%, markets need flawless execution to justify current prices.

BOTTOM LINE:

January ended with a whimper, not a bang. Tech is under pressure, commodities reversed violently, and the Fed Chair transition adds another variable to an already complex tape. Earnings and jobs data will determine whether this market finds its footing or if we’re due for a deeper pullback.

The bull market isn’t dead, but it’s facing adult supervision. Buy-the-dip worked in 2023-2025, but 2026 may demand more discipline. Watch for confirmation that earnings growth can support these valuations, or prepare for volatility.

I cleaned up P&L. OPEN I still love and will revisit, and if you’re still long, I wouldn’t worry too much on this one, longer-term play anyway. MSFU I telegraphed on the chat that I would hold, so paying a little for that now, but have every confidence in Mr. Softee.

Tough to find a sector at this moment in time that I love, because everything seems under pressure. But as always, things will re-emerge.

See you Monday morning.