Dow -285.30 at 49097.50, Nasdaq +65.22 at 23501.27, S&P +2.26 at 6915.60

Russell 2000: +7.5% YTD

S&P Mid Cap 400: +5.5% YTD

DJIA: +2.2% YTD

Nasdaq Composite: +1.1% YTD

S&P 500: +1.0% YTD

Last week, in a shortened trading period following the Martin Luther King Jr. holiday, U.S. equities navigated choppy waters marked by geopolitical tensions and mixed economic signals, ultimately posting modest losses while remaining near record highs.

The S&P 500 slipped 0.3% to close at 6,915.6, the Dow dropped 0.5% to 49,098.7, and the Nasdaq dipped just 0.1% to 23,501.2, with technology stocks weighing on cap-weighted benchmarks amid broader rotation into small-caps, value, and equal-weight segments.

Sector highlights included strong gains in energy (+3.1%) and materials (+2.6%), buoyed by commodity strength, while financials and real estate each fell 2.5% amid interest rate sensitivities. Economic data provided a resilient backdrop, with third-quarter GDP revised upward to a robust 4.4%.

Corporate earnings outlooks brightened, with Q4 S&P 500 growth projections ticking up to 8.2%.

Commodities rallied amid uncertainty, with gold surging to around $4,980 per ounce and silver breaking above $100, while China’s 2025 GDP met its 5% target but slowed in Q4 to 4.5%.

Looking forward, markets anticipate no rate change at the upcoming Fed meeting, with focus on inflation progress and potential cuts later in the year.

Importantly, Microsoft, Meta Platforms (META 658.76, +11.13, +1.72%), Apple (AAPL 248.04, -0.31, -0.12%), and Tesla (TSLA 449.06, -0.30, -0.07%) all report earnings next week.

The price action of these mega-cap stocks will continue to get attention as the market heads into a week that will see four of the “magnificent seven” names report earnings. With the market still near record highs, impressive upside guidance will be as important as beating earnings expectations to maintain upward momentum. It’s always about guidance.

News this weekend………………..

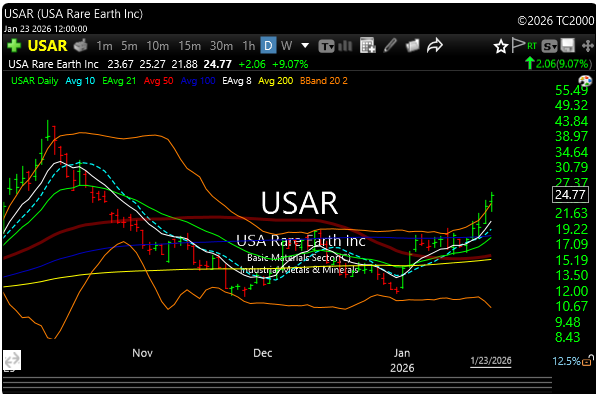

The Trump Administration is set to invest $1.6 billion in USA Rare Earth Inc (USAR) for a 10% stake in the company, per FT. The stock was also up +9% on Friday and +46% over the last 5 days. Someone always knows. Trump wants more US rare earths.

Everyone is a silver expert now, but let’s talk some copper.

Bernstein expects a massive copper shortage to begin in 2027, right as AI infrastructure moves into mass scale. AI only scales on electricity, and electricity scales on copper because a single $NVDA Blackwell rack pulls ~130 kilowatts, and every megawatt delivered to a data center requires copper at every layer of the stack. This also lines up almost perfectly with Blackwell moving into mass deployment, inference overtaking training, and hyperscalers shifting from single flagship data centers to regional clusters. Everyone is trying to double capacity at the same time, which is why the AI supercycle and the copper supercycle are one and the same.

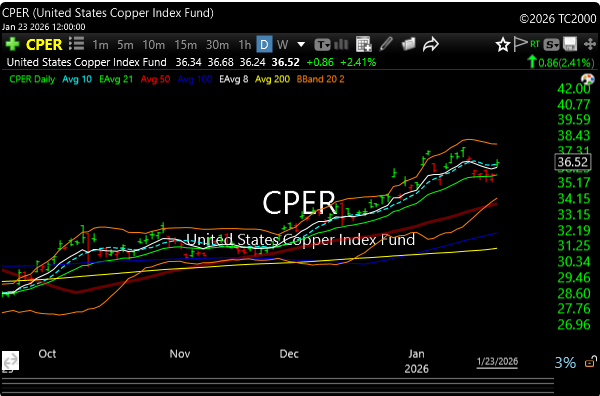

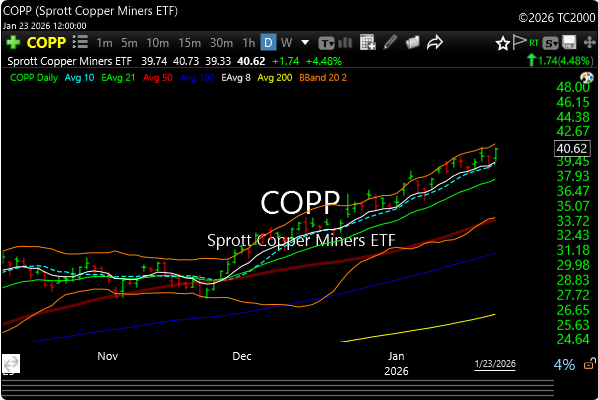

Two plays, and I like these as longer-term 12-18 month holds.

(CEPR)-United States Copper Index Fund CPER– The closest pure copper ETF. Why it’s the closest: This ETF tracks the SummerHaven Copper Index Total Return, which uses copper futures contracts to mirror spot copper prices. It avoids mining company risks (like operational issues or dividends) and provides direct commodity exposure without holding physical metal. While not physical, it’s the most straightforward way to bet on copper price movements, with minimal deviation from spot over time (accounting for futures roll costs like contango).

(COPP)– Sprott Copper “Miner” ETF– Why it’s close: This focuses on copper mining stocks (95%+ of holdings) but allocates ~5% to physical copper by investing directly in units of the Sprott Physical Copper Trust (SPHCF). Sprott Physical Copper can be hard to find and buy sometimes.

It’s the only U.S.-listed ETF with any physical copper component, making it a blended alternative if you want some direct metal alongside producers.

It will be a busy week with earnings and Fed comments.

See you on Discord in the morning. Have a great night and enjoy the games.