In case you haven’t read the funny pages this weekend yet, POTUS is putting tariffs on any country that doesn’t support his move for Greenland.

As a result, this weekend, the EU has delared 25% tariifs on the USA if Trump proceeds with his threat.

The markets are closed today, but index futures are still trading and are down about 1% as we head into Monday evening. It’s so hard to have a relaxing weekend these days. Let’s not forget we could light up Iran again at any point. Maybe we have become numb to bombings, not sure.

Natural gas was up 15% when I last checked, due to frigid weather across the country. It had been uo 20% in the morning hours.

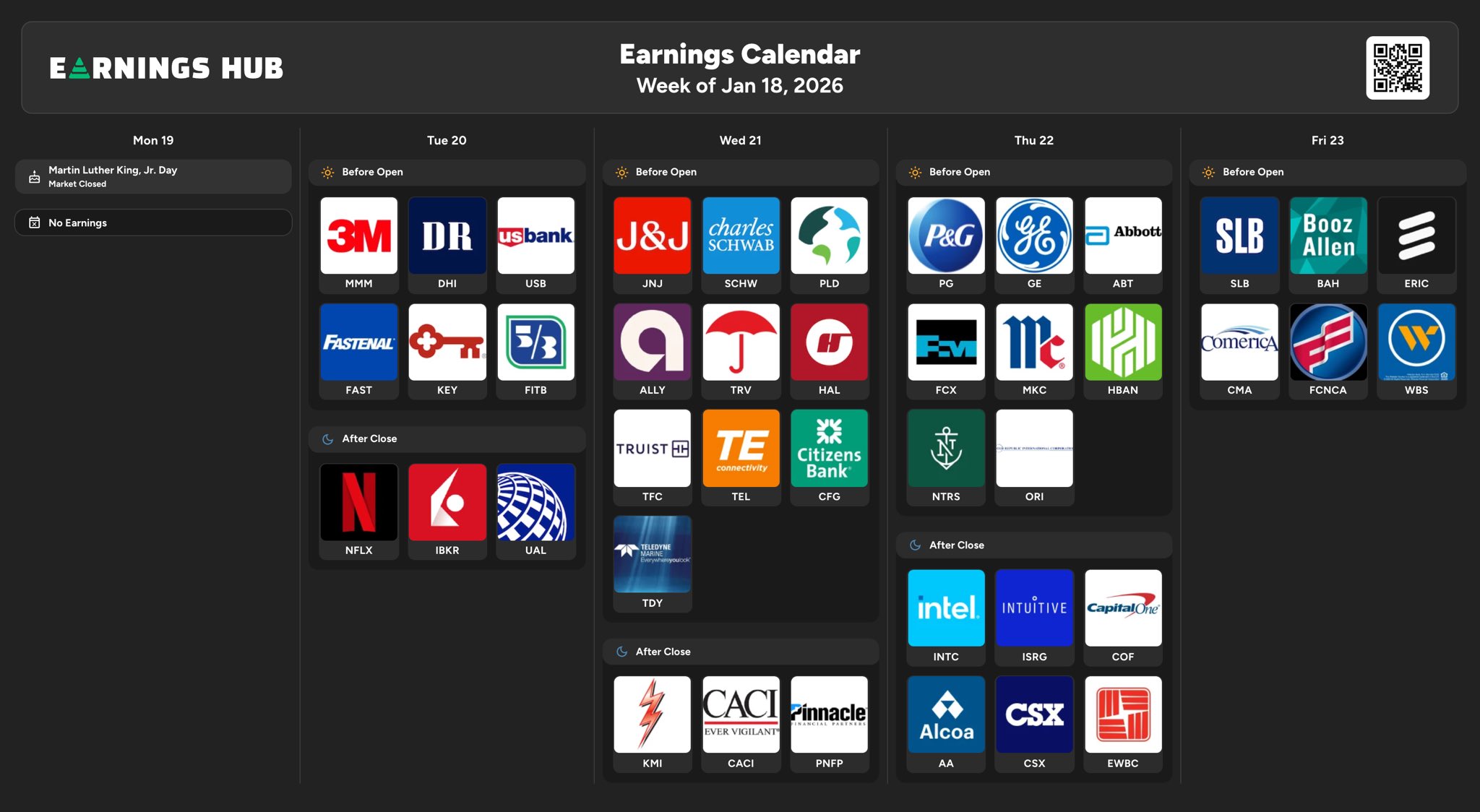

Earnings will be coming in hot and heavy as we enter the week, so we need to be aware of that.

Bitcoin is down 2.5% as I write in the early afternoon.

The NYSE is set to launch 24/7 US stock trading via a new on-chain, tokenized exchange. The thinking is that it will be SEC-approved by the end of summer. Great for innsomniacs and degenerate traders. 😉

Long Adderall

Fun fact: Next week is NFLX’s strongest seasonal stretch. +15% average return, 80% green closes.

What I ama little concerned about…

We aren’t in extreme greed territory, but closed last week at the highest levels of greed since September. Also, BofA on the CTA crowd coming into this week: CTAs with medium- to long-term trend signals remain heavily stretched long across U.S., European, and Japanese equities. With realized equity volatility at depressed levels, vol-sensitive strategies have likely pushed aggregate systematic exposure to its highest level in roughly five years. The risk profile is asymmetric: downside moves could trigger material CTA unwinds, while flat-to-higher markets would likely see only gradual adjustments. Their models suggest CTA selling would begin after declines of roughly 3% in the S&P 500 and Nasdaq, 5% in the Russell 2000, 3.5% in the EURO STOXX 50, and 6% in the Nikkei.

What CTAs do matters.

As you know, I play lighter and less through earnings season, but there is always a setup somewhere, so stay tuned.