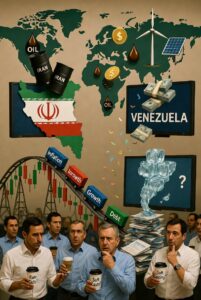

The first full trading week of 2026 (January 3–9) delivered a strong rebound for U.S. stocks, with major indexes posting solid gains and closing at or near record highs on Friday despite ongoing geopolitical tensions and mixed economic signals. Markets shrugged off the dramatic U.S. military raid that captured Venezuelan leader Nicolás Maduro on January 3, which initially boosted energy stocks on speculation about potential access to Venezuela’s vast oil reserves. Instead, the focus shifted to economic data, policy developments, and a rotation away from mega-cap tech toward cyclical and value-oriented sectors.

Major Index Performance: All three major benchmarks ended the week higher, recovering from late-2025 weakness: Dow Jones: Closed at 49,504.07 on January 9, up about 2.3% for the week — its strongest weekly gain in recent months.

S&P 500: Finished at 6,966.28, up 1.6% weekly, with multiple record closes along the way.

Nasdaq Composite: Settled at 23,671.35, gaining 1.9% for the period.

Friday’s session capped the rally, with the Dow up 0.48%, S&P 500 up 0.65%, and Nasdaq up 0.82% — driven by a softer-than-expected December jobs report (fewer jobs added but unemployment dipping to 4.4%), which reinforced expectations for Federal Reserve rate cuts later in the year.

Sector Highlights and Market Rotation theme emerged:

Rotation from overextended tech/growth stocks to laggard sectors that benefit from lower rates, fiscal stimulus, and domestic policy shifts. Materials and industrials led gains, with materials up around 1.8% on the final day.

Utilities and housing-related stocks surged — homebuilders like D.R. Horton (+7.8%), PulteGroup (+7.3%), and Lennar (+8.8%) rallied after President Trump directed mortgage bond purchases to lower rates (now at their lowest in nearly three years).

Energy saw volatility but ended positive, with oil prices (WTI and Brent) up over 3% amid supply concerns from Venezuela, Russia, Iraq, and Iran.

Semiconductors mixed but supportive overall — Intel surged nearly 11% after Trump’s praise for a meeting with its CEO, while Broadcom rose 3.8%. Some AI-related names, such as Nvidia, faced pressure midweek.

Small-caps outperformed, with the Russell 2000 gaining significantly more than the broader market, signaling broader participation. Key Events and Drivers:

Geopolitical spotlight on Venezuela boosted defense and energy early in the week, though markets quickly priced in the event as contained.

Massive anti-government protests in Iran are entering their second week (or longer in some reports), with reports of a nationwide communications blackout, overwhelmed hospitals, school closures in several provinces, and an intensified crackdown by authorities. Protests have spread to multiple cities, with some Iranians using contraband Starlink or neighboring cell service to communicate. International solidarity demonstrations (e.g., in Berlin) are also occurring. Iranian officials have blamed external forces like the US and Israel for the violence.

President Trump is pushing hard on Greenland, repeatedly stating the US needs to “own” or control it for strategic reasons.

Policy wins for housing and manufacturing — including deals like Johnson & Johnson’s agreement to lower drug prices in exchange for tariff relief and increased U.S. investment.

Economic data provided a mixed but dovish signal, keeping rate-cut hopes alive.

Corporate notes included strength in home improvement (e.g., Home Depot) and power/utilities (e.g., Vistra up 10.5% on nuclear deals).

Overall, the week reflected optimism for 2026: continued AI enthusiasm, potential rate relief, fiscal support, and a broadening rally beyond Big Tech. Investors now eye earnings season and any Supreme Court clarity on tariffs. Despite headline risks, bulls maintained control — a promising start to the year!

Remember that earnings will start this week as many of the big banks kick us off.

If you read last weekend’s market report, you saw some of my watchlist stocks pop, some too fast to catch, perhaps, like KTOS and ONDS.

EOSE had a good week, and although it has already undergone an explosive move since 2024, its monthly chart suggests we are still early, and in the worst case, right on time. EOS is a clear leader in clean energy storage solutions. Its year-over-year quarterly revenue growth is exploding, and its estimates for the next three quarters are huge. This one could be a big winner in 2026, and I see it as a solid “put-away” type name. Actionable here. Buy the 14.75-15.50 zone. Risk area 13

On the crypto front, it seems that Ethereum and Bitcoin are still guilty until proven innocent. I’m watching them both for a tell.

EVLV is a growth story. AI for airport security, etc. Seems to be setting up bullishly on the chart for now. Buy range 7.15-740. Risk area 6.00-6.50

I know some of you like to play these high “income” ETFs. I’ve never really trusted or endorsed them because many are just a return of capital and charge you a fee for giving you back your own money. Here is a list of some. Always try to look at the ones that have “NO PRICE DECAY” if you feel the need to own some of these. Here’s the link if you’re interested in this stuff.

Have a great night, see you in the trading room in the morning.