You all know about Venezuela by now.

Venezuela currently has 303 billion barrels of crude oil reserves, which Trump says the US now controls. Oil prices are trading at ~$57/barrel, making Venezuela’s total reserves worth $17.3 TRILLION. Even if the US sells this oil for HALF of the market rate, that’s still $8.7 TRILLION. In other words, in 12 hours, the US has gained control of oil reserves worth more than the entire GDP of ALL countries in the world, aside from the US and China. That’s 4X Japan’s GDP. Most people do not realize how much the world has just changed. Oil markets will react to this news for the first time on Sunday at 6 PM ET. The next few days will be interesting.

Also………………..

(#1) Venezuela currently has 1.200 trillion cubic feet of natural gas reserves, ranking 34th in the world (#2). 300 billion barrels of crude oil reserves, the largest in the world (#3). 4 billion tons of iron ore reserves, worth nearly $600 billion. (#4).- 8,000+ tons of gold resources, the largest in Latin America. (#5). 500+ million tons of coal reserves (#6)—2% of the world’s total renewable freshwater resources (#7). With untapped strategic minerals, including nickel, copper, and phosphates, Venezuela is now a “strategic” US asset.

Chevron (the most significant player in Venezuela) will be a huge beneficiary. The stock popped on Friday with considerable call option activity. Someone always knows something. I’m not in that club.

A lot of Venezuela’s oil is very heavy crude. The publicly traded refiners here are primarily based in Louisiana and Texas. They can handle heavy crude. Those stocks are: PSX, MPC, VLO, PBF, and XOM.

It was a wild year for AI and related names.

Memory is expected to be the fastest-growing market in the semiconductor industry in 2026, with sales currently projected to rise 39.4% YoY to nearly $295 billion, accelerating from 27.8% growth in 2025. $MU, $NVDA, $AMD, and $AVGO are names to watch in 2026.

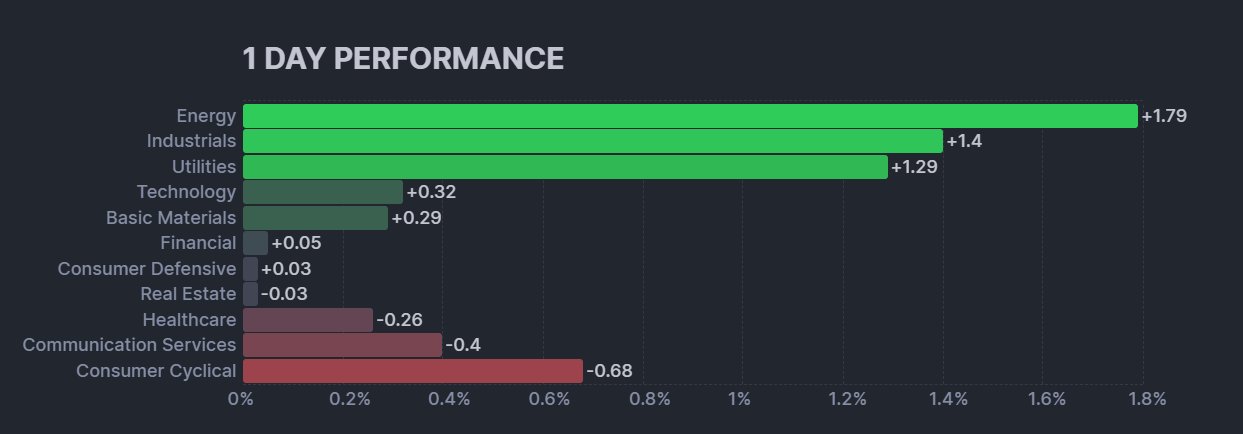

The upcoming week will be an interesting one for the market, mainly because of Venezuela. Bullish or bearish?

My initial takeaway is bullish: oil prices should drop, which should translate to lower inflation, which should translate to even lower Fed rates.

Tomorrow could be tricky, but here are some names I like a lot as we move forward. I will get more specific as the week unfolds.

BABA/BABX

FXI, KWEB, YINN (all China ETFs, feels like they want to go full stimulus)

UMAC/KTOS (Drones)

ONDS (broadband for mission-critical businesses)

QBTS, IONQ, LAES (quantum)

EOSE (zinc batteries)

IBIT/ETHA (jury still out, but watching closely)

OPEN (Homeowners receive instant cash offers online).

***********************************************************************************************************************88

For me, January is all about slowly getting ready. Get aggressive when things really line up later on. Don’t rush things. The key to winning the game is staying in the game.

Diversify, don’t get crazy overweight in any one position.

The mental game is always the most important part of the execution game. Slow and steady wins the race; there is no rush this week, especially given the geopolitical backdrop of Venezuela.

Let’s have a great year.