U.S. stocks slipped on Monday as traders stayed cautious ahead of a data-heavy week that could sway expectations for interest rates and the path of the economy. The S&P 500 fell about 0.2% to 6,816, the Dow edged down 0.1% to around 48,417, and the Nasdaq lagged with a 0.6% drop near 23,057, weighed again by weakness in major AI and tech names like Broadcom and Oracle, even as Nvidia managed a small gain.

Under the surface, breadth was slightly positive in the S&P even as the index ticked lower, reflecting ongoing rotation out of crowded AI/mega-cap trades and into more cyclicals and value areas. At the same time, small caps (Russell 2000) also slipped about 0.8%. Outside equities, gold futures hovered near record highs as investors looked for defensive hedges. At the same time, Bitcoin dropped more than 3% alongside declines in crypto-related stocks, highlighting a modest risk-off tone across speculative assets.

It was a crappy day overall, but to be honest, the indexes have held all the critical moving averages. I’ve also noticed over the years that Mondays tend to be weak after a big option expiration the previous Friday.

TSLA was the standout today, but everything else was heavy and mostly lower.

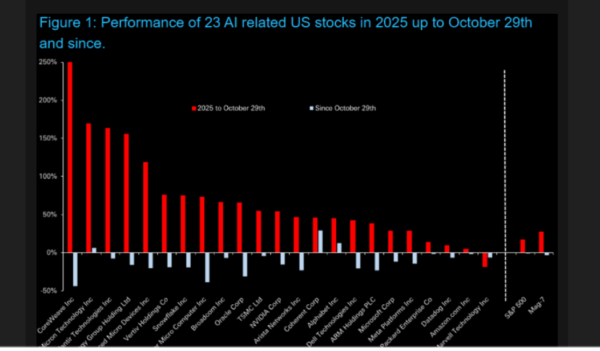

Below is a visual of AI lately.

DB’s chart of the day tracks 23 AI-related stocks, comparing year-to-date performance up to October 29 with returns over the roughly six weeks since. Before 29 October, just one stock was down on the year, and the group had posted an average unweighted gain of +70%; since then, the picture has shifted sharply, with 20 of the 23 now trading lower.

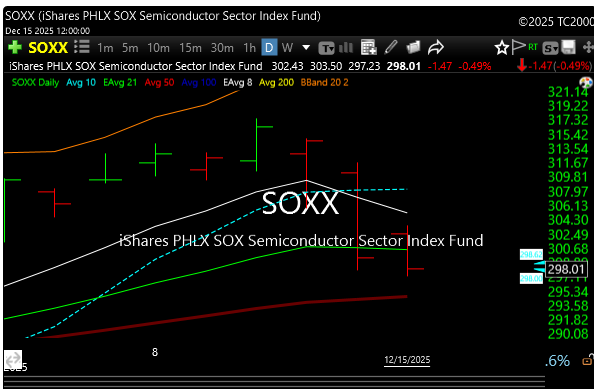

Hedge fund positioning in semis got back to peak levels just in time for the biggest SOX puke in a very long time.

Not many humans are paying attention to Japan at all, but the implications of Japan’s long-end rise can be huge. This isn’t a local story; it carries global spillover risk. Notably, NVDA topped almost perfectly as the Japanese 10-year kicked off its latest explosive move.

It also feels (for now) that our bond market isn’t buying the lower-rate narrative as rates continue to tick higher.

However, given all the things that can go wrong, I’m still bullish on year-end. With that said, the market cares nary a wit what I think or feel.

See you guys in the morning.