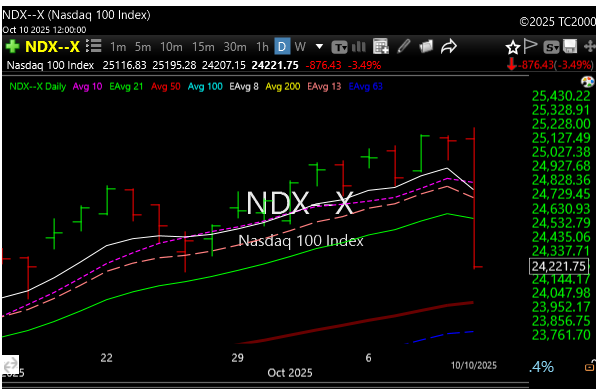

Stock indexes gave up an early advance on Friday and sold off sharply, with the S&P 500 and Nasdaq 100 sliding to 2-week lows and the Dow dropping to a 1-month low. Stocks plummeted as US trade tensions escalated with China after President Trump threatened a “massive increase” of tariffs on Chinese goods, citing China’s recent “hostile” export controls on rare-earth minerals. Trump also said there seems to be no reason to meet Chinese President Xi Jinping at the APEC meeting in South Korea later this month.

The landslide then began.

Major tech and AI companies like Nvidia, Amazon, and Tesla lost about 5% each, wiping out $770 billion in market cap. Semiconductor stocks, such as AMD and Micron, fell 6-8% after China imposed new rare earth export controls and launched an antitrust probe on Qualcomm.

Bitcoin plunged below $108,000 before rebounding to $113,000, with more than $19 billion wiped out in crypto liquidations in just hours. Ethereum and XRP dropped 12-22%, reflecting trader panic and forced selling linked to margin calls and leveraged positions.

30 minutes before President Trump’s tariff announcement yesterday, a “whale” took a multi-million dollar SHORT in Bitcoin. 1 hour later, crypto saw its largest ever liquidation, and this position was liquidated for +$192 MILLION in profit. Did someone know?

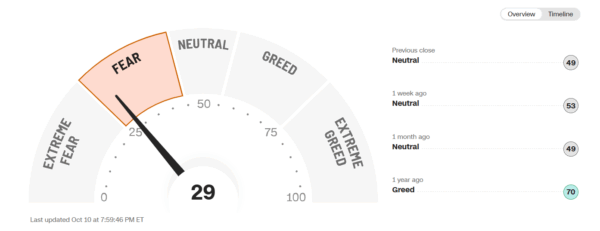

The CBOE Volatility Index (VIX) soared 32% to 21.66, the highest since August, as investors rushed to hedge downside risk. Traders reacted swiftly to tariff headlines and the ongoing US government shutdown, amplifying anxiety.

Crude oil prices tumbled to $58.90, the lowest since May, as a Gaza ceasefire removed geopolitical risk premiums and the trade war threatened global economic growth. OPEC+ plans to boost output in November, adding further downward pressure.

My takeaway? We were overbought, got a bit frothy, so the market needed a reason to let some air out. It always happens this way……they wait for a headline.

Some stocks that we all know and love will set up again soon. Opportunities will be everywhere, and you won’t feel like you’re chasing.

My silver lining, perhaps, is that Trump said he may still meet with Xi. This comment was at around 5:30 on Friday, and if you look at the futures, they rallied on that.

So, if we get a TACO Monday (Trump Always Chickens Out), we could get a vicious bounce. This acronym, by the way, started during his first administration. Threaten, then walk it back. It’s all part of negotiating.

Let’s see how Monday goes. Maybe I’ll add some pullback names.

“Smart men go broke three ways: liquor, ladies, and leverage.”-Charlie Munger.

“Everyone Wants the Plant. Few Plant the Seed. In the age of social media, everything moves at the speed of instant gratification. People chase followers, likes, and quick reactions to market movements. That constant demand for immediacy spills over into how they approach trading and the markets. Everyone wants instant reasoning, instant validation, instant results. But few take the time for introspection to actually plant the seeds that build a lasting future in the markets. Most want the plant fully grown. They want to be fed information instead of truly learning about themselves, about how they react to different market environments, and what they could do better the next time. What I’ve learned over my career is the power of planting the seed. It’s about investing in the process, slowing things down even when the world speeds up. It’s about being willing to learn, to adapt, and to understand that none of us is ever done growing. Those who slow down in a fast-paced environment will often outpace those who race for instant results. Show gratitude. Stay open. Be willing to learn every day. Slow things down. Plant the seeds now, so your future has roots.” -Anonomous