Dow -189.73 at 38496.59, Nasdaq +42.95 at 16777.98, S&P -5.60 at 5271.91

Stocks experienced mixed action on the first session of the new month. The S&P 500 (-0.1%) and Dow (-0.5%) settled lower while the Nasdaq Composite logged a 0.3% gain.

A solid gain in NVIDIA (NVDA 1150.00, +53.67, +4.9%), which introduced new products, limited downside moves in the major indices, but concerns about economic growth kept the broader market in check.

The aforementioned concerns were stirred by this morning’s release of the ISM Manufacturing Index for May, which reflected a faster pace of contraction than the market expected (actual 48.7%; expected 49.6%). A reading below 50% indicates a contraction in activity.

Yields moved lower in response. The 10-yr note yield fell 11 basis points to 4.40% and the 2-yr note yield fell seven basis points to 4.82%. Dropping market rates had been a source of support for equities recently, but worries about an economic slowdown that could affect earnings prospects drove stock market action today.

WTI crude oil futures ($74.29/bbl, -2.79, -3.6%) settled sharply lower in another manifestation of slowdown concerns, which could translate to weaker demand for oil.

This price action contributed to the selling in the S&P 500 energy sector. It was the worst performing sector by a decent margin, dropping 2.6%.

NVDA caught an upgrade to $1500 today. It helped the stock, but the Nazzy was churning all day.

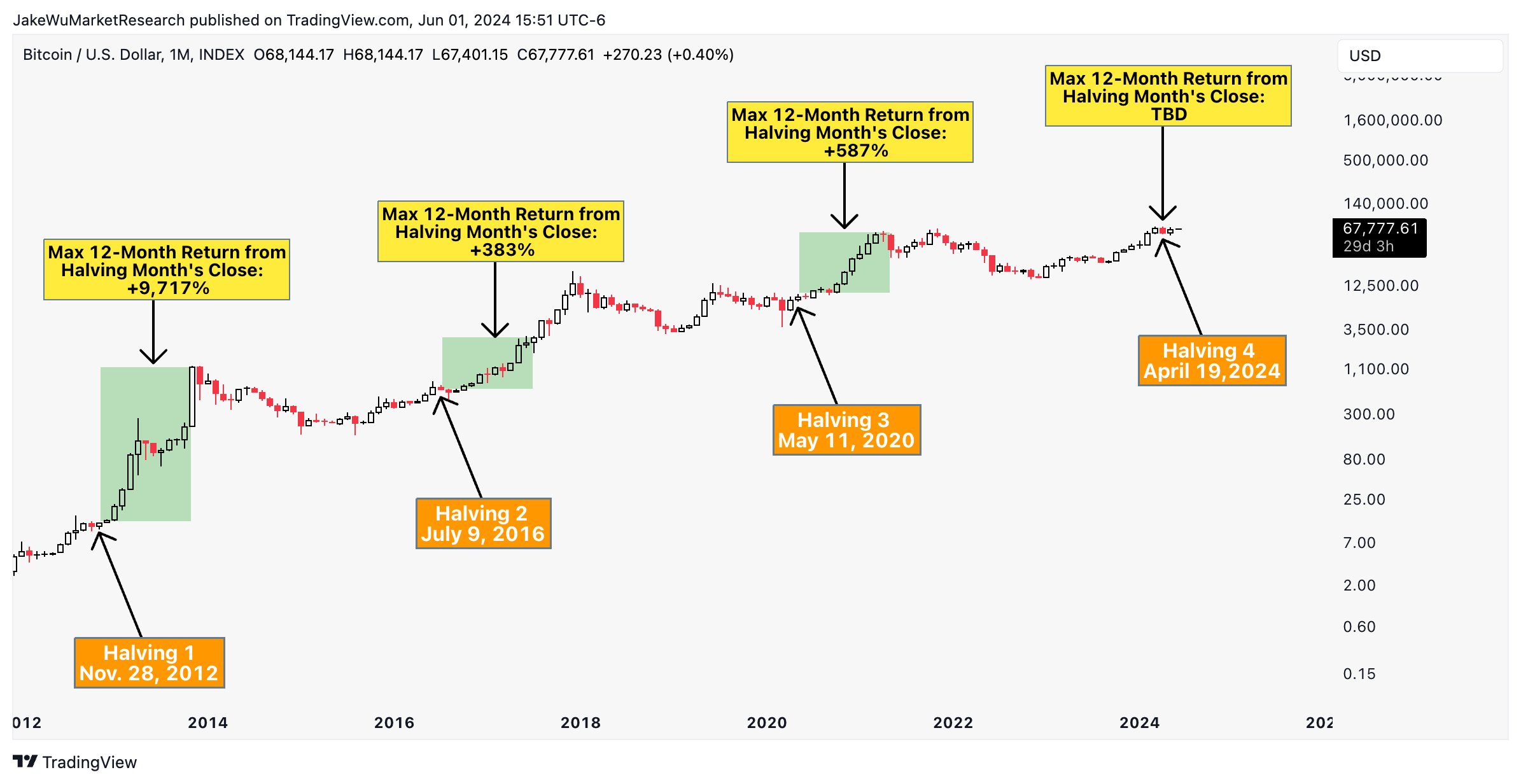

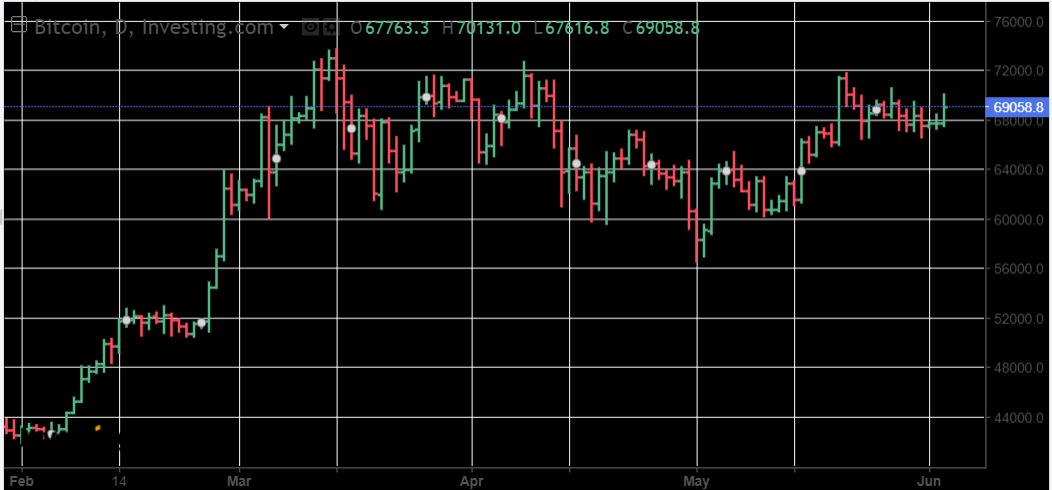

Ethereum went sideways today but Bitcoin was +2.3%.

We are playing Bitcoin via IBIT and the chart continues to look very good. Bitcoin is coiling bullishly on the chart so maybe we get another leg higher soon.

I removed GE from the watchlist today. We got triggers from AR, KTOS, and ARM today.

See you guys in the morning.