Dow +269.24 at 39781.37, Nasdaq +32.43 at 16401.83, S&P +16.91 at 5241.53

The stock market followed yesterday’s solid FOMC-fueled rally with another day of gains. Today’s close left the S&P 500 (+0.3%), Nasdaq (+0.2%), and Dow (+0.7%) at fresh all-time highs. The Russell 2000 outperformed other major indices, logging a 1.1% gain.

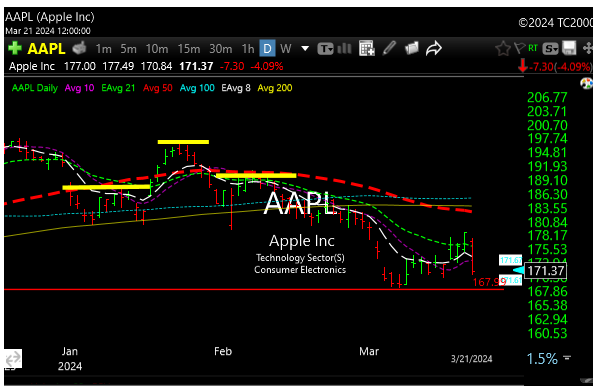

However, the S&P 500 and Nasdaq closed near their lows of the session, due in part to a sizable decline in shares of Apple (AAPL 171.29, -7.38, -4.1%). This price action followed news that the Department of Justice filed an antitrust lawsuit, alleging the company blocked software and gaming companies from offering better options. Apple said it will “vigorously” defend itself. AAPL looks horrible, next support is 168.

The loss in Apple and a sharp earnings-related decline in Accenture (ACN 345.03, -35.41, -9.3%) limited the upside movement in the S&P 500 information technology sector, which eked out a 0.1% gain.

Strength in the semiconductor space provided some offsetting support to the information technology sector following pleasing earnings and guidance from Micron (MU 109.85, +13.60, +14.1%). Broadcom (AVGO 1348.00, +72.00, +5.6%) was another influential winner from the space, trading up in sympathy with Micron and following an upgrade to Outperform from Market Perform at TD Cowen. The PHLX Semiconductor Index (SOX) climbed 2.3%. The top chip analyst on the Street thinks AVGO could have $60 in earnings over the next 12 months. It’s an expensive name, but one to watch.

See you in the morning. We’re getting stretched here. Tomorrow we see weekly options expire.