Dow +90.99 at 39087.38, Nasdaq +183.02 at 16274.94, S&P +40.81 at 5137.08

Nasdaq Composite: +8.4% YTD

S&P 500: +7.7% YTD

Dow Jones Industrial Average: +3.7% YTD

S&P Midcap 400: +4.6% YTD

Russell 2000: +2.4% YTD

The stock market had a solid showing on the final day of the week. The day started on a mixed note, though, following Thursday’s gains that saw the Nasdaq hit a record closing high for the first time in two years.

Stocks started to climb as Treasury yields turned lower in response to this morning’s data. Many stocks came along for the upside ride on Friday, which brought the S&P 500 (+0.8%) and Nasdaq Composite (+1.1%) to fresh record closing highs.

The 10-year note yield stood at 4.28% before the February ISM Manufacturing Index showed the contraction in manufacturing activity accelerating and pricing pressures moderating. It settled at 4.18%, which is seven basis points lower than yesterday. The 2-yr note yield slid 11 basis points to 4.53%. Other data today included a weaker-than-expected Construction Spending report for January.

The broad buying activity in stocks left eight of the 11 S&P 500 sectors higher. The information technology sector (VGT), which constitutes 30% of the index, closed at the top of the leaderboard with a 1.8% gain. This price action was influenced by relative strength in mega-cap and semiconductor-related components.

Strength in semiconductor stocks (SMH) also left the PHLX Semiconductor Index with a 4.3% gain. NVIDIA (NVDA 822.79, +31.67, +4.0%) was a winning standout from the space, closing above a $2 trillion market cap for the first time today. See AMD last week. I do believe dips will be bought.

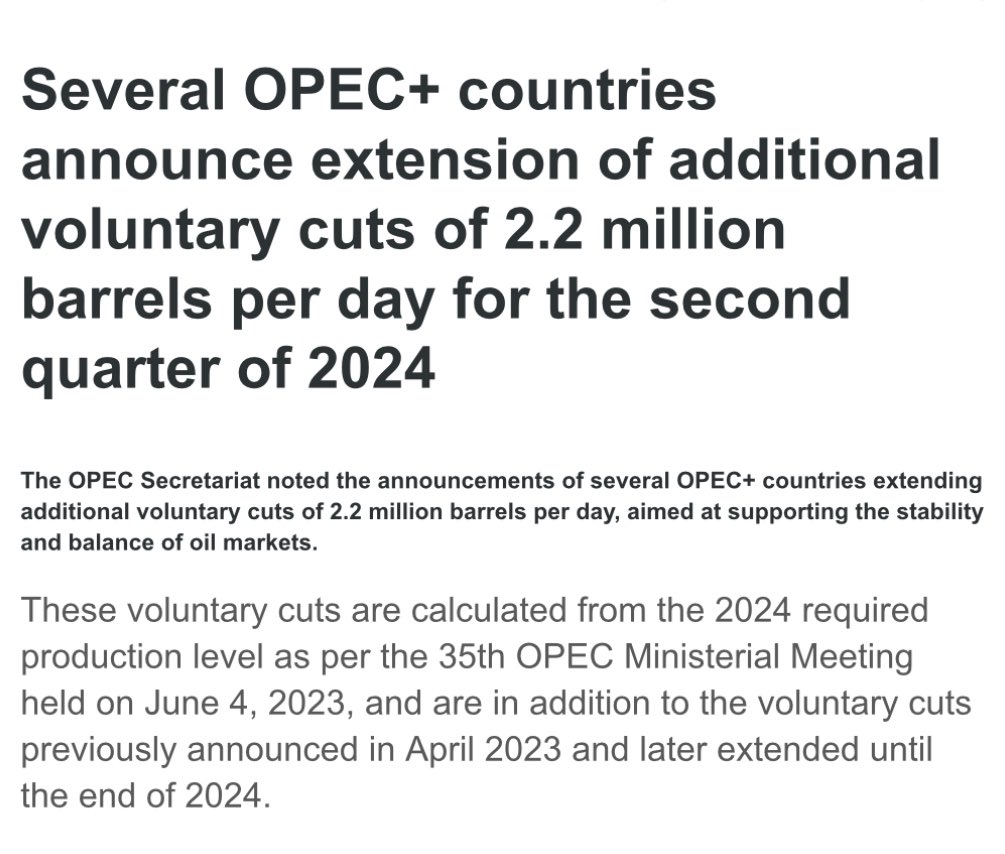

The energy sector (+1.2%) was another top gainer, rising alongside WTI crude oil futures, which settled 2.2% higher at $79.97/bbl.

Regional banks

The worst part is, that the Bank Term Funding Program expires next week. This is the emergency loan program established for regional banks last year during the crisis. What’s next for regional banks?

The underperformance of the financial sector is related to weakness in regional bank shares after New York Community Bancorp (NYCB 3.55, -1.24, -25.9%) acknowledged last night that it has identified material weaknesses in the company’s internal controls related to internal loan review.

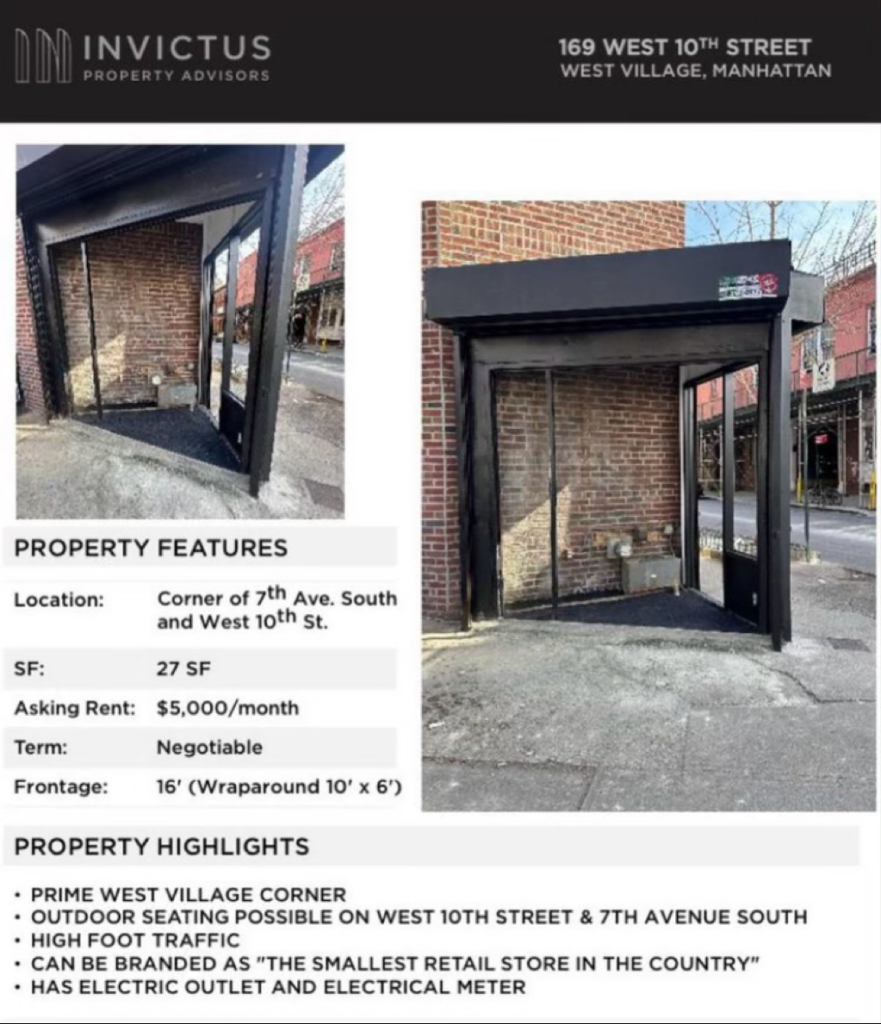

Speaking of commercial real estate, how about 27 sq. feet in Greenwich Village NY for 5k a month? Not a bubble.

It was a phenomenal week for biotech, although extended, as XBI and IBB ETFs continued their upward trends.

Energy (XLE/ERX) has broken above downtrend line resistance and crude oil is moving above $80. OIH and XES are also looking bullish.

GLD- Gold broke out on big volume. I will look for some setups in some miners this week.

Semiconductors (SMH/SOXX) inflows have surged to the highest levels on record over the last two weeks, per Barclays, the last time we saw a surge like this was in late 2021, just before there was a rather large wave of selling.

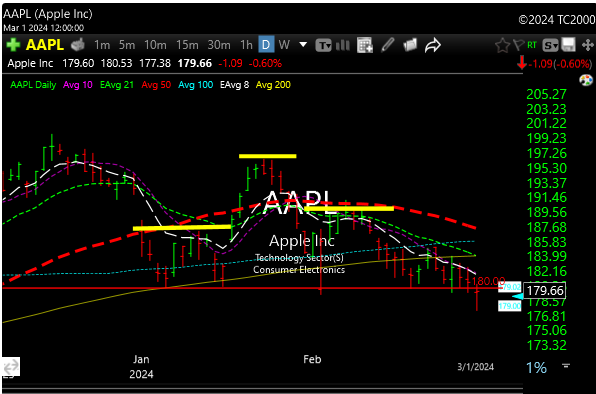

Apple– Apple had its 3rd consecutive weekly close below its 200D moving average and closed at its lowest price since early November.

Please check the P&L on the homepage as we have been busy. The new March P&L is also up.

We are slightly overbought depending on what index you look at and some individual stocks are extended so when we make new highs it pays to tighten up stops a little and sell a little into strength safe. Nothing wrong with taking some money to the bank if you can.

Good luck next week and good trading.

Here are some setups. Video analysis at the bottom of the post for these 5 names.

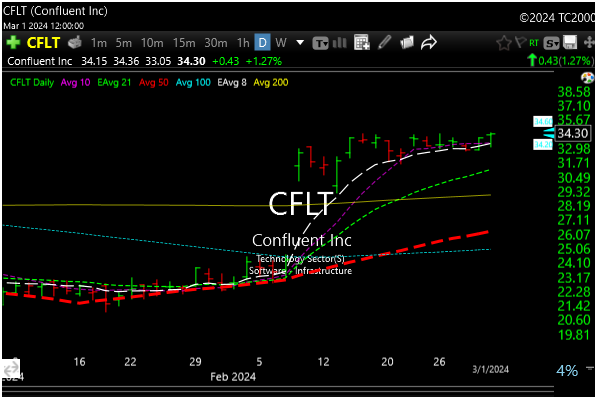

CFLT– Bullish coil after the big breakaway gap. Consolidating. Triggers at 34.50. Stop 32.50 which is just under the 8-day moving average. The company sees 325% profit growth in 2024, Confluent stock is rising as another option in the AI space.

DAWN- (Biotech) Starting to flag. Triggers at 17.75. Stop 16.30 which is just under the 8-day moving average.

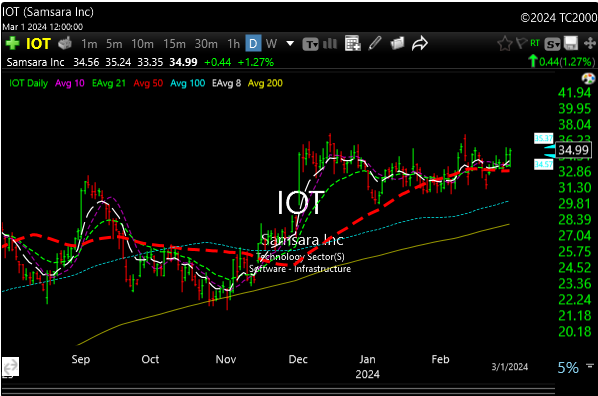

IOT- Triggers 36.25. Stop 33.20

STTK– (Biotech)Triggers at 10.40. Stop 8.70-9.00

DVN– I want to put this one on for a core holding for the balance of the year if you’re interested in that time frame. If DVN can break out of the multi-year falling wedge it could make some noise. Triggers 44.50-45.00. Stop $40. Thats the low.

Crude acted well last week and could get a bump off this….