Dow +125.69 at 38797.38, Nasdaq -48.12 at 15942.55, S&P -4.77 at 5021.84

It was a strong day for the stock market. Many stocks finished higher as evidenced by the positive bias in market breadth. Advancers led decliners by a 7-to-2 margin at the NYSE and by a 2-to-1 margin at the Nasdaq. The Dow Jones Industrial Average saw a 0.3% gain, marking another record closing high, while the Russell 2000 jumped 1.8%, continuing its recent outperformance. With today’s gain, the Russell 2000 is now positive on the year with a 0.9% gain.

Meanwhile, some mega cap stocks succumbed to profit-taking activity, weighing down the S&P 500 (-0.1%) and Nasdaq Composite (-0.3%).

The S&P 500 and Nasdaq Composite had been trading higher earlier, up as much as 0.4% and 0.6%, respectively. The indices started to decline around mid-day, though, as selling interest picked up in some overbought constituents.

Amazon.com (AMZN 172.34, -2.11, -1.2%) and Microsoft (MSFT 415.26, -5.29, -1.3%) were among the influential losers from the mega-cap space, dropping more than 1.0% today. AMZN and MSFT are still up 13.4% and 10.4%, respectively, for the year.

Notably, some of the largest gainers to this point in the year from the mega-cap space still finished higher today. Specifically, Meta Platforms (META 468.90, +0.79, +0.2%) and NVIDIA (NVDA 722.48, +1.15, +0.2%) closed in the green, bringing their 2024 gains to 32.5% and 46.3%, respectively.

META and NVDA fell from their session highs, however, as their mega-cap peers extended early losses or rolled over from early gains. META had been up as much as 2.4% today and NVDA had been up as much as 3.4%.

Semiconductor stocks also rolled over from early strength, adding downside pressure to the major indices. The PHLX Semiconductor Index (SOX) had been up as much as 1.7% at its high but closed with a 0.2% loss.

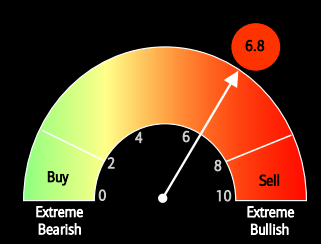

The rollover action seen today was related to the market’s growing sense that things are due for a pullback.

PTGX triggered today (Weekend Market Report), and I added ONON and TWST as new longs.

Be careful up here as we have come far and fast and a lot of names are extended. Check the P&L tonight to see where I have raised stops.

Please do me a favor tonight, it won’t take two minutes.

I’m trying to make the website better for you and I would appreciate it if you would answer this quick poll for me.

Thanks folks, I appreciate it.