We are all in the gutter, but some of us are looking at the stars.

Oscar Wilde

Friday

Dow -20.56 at 37689.54, Nasdaq -83.78 at 15011.35, S&P -13.52 at 4769.83

2024

Nasdaq Composite: +43.4%

S&P 500: +24.2%

Russell 2000: +15.1%

S&P Midcap 400: +14.5%

Dow Jones Industrial Average: +13.7%

The major indices closed with losses on the year’s final trading day. Volume picked up compared to recent sessions but was still lighter at the NYSE.

The Russell 2000 underperformed other indices, registering a 1.2% loss. Meanwhile, the Dow (-0.1%), S&P 500 (-0.3%), and Nasdaq (-0.6%) closed with modest losses off their lows of the day. Relative strength in some mega-cap names had provided support to the three major indices early on, leading them to trade slightly higher than yesterday’s closing levels.

Amazon.com (AMZN 151.94, -1.44, -0.9%), which was up 0.3% at its early high, and NVIDIA (NVDA 495.22, 0.00, +0.0%), which was up 1.0% at its early session high, were standouts in that respect—just about everything retreated from session highs around mid-morning, though.

The lack of strong conviction was unsurprising on the last session of the year after a surge higher since October, and with the S&P 500 still trading just below its all-time high. The S&P 500 has climbed 15.8% since October 27, registering a 24.2% gain this year.

A look back on 2023 in the market: Heading into this year, the average forecast showed the S&P 500 closing Friday at ~4,000. Currently, the index is at 4,760 and less than 2% away from a new all-time high. In other words, we are ~19% ABOVE Wall Street’s average year-end target. Interestingly, just 2 months ago, the S&P 500 was trading at 4,100, roughly in line with the average year-end forecast. These last 2 months caught institutional investors completely off guard. It’s all due to the “Fed pivot.”

It has been quite a year. You had the collapse of regional banks and the near collapse of some commercial real estate, then the year flipped when NVDA put AI on the map. We also had the coining of the term “Magnificent 7” to replace FAANG. We ended with a perceived Powell pivot to spark a rally, unlike anything we typically see.

This is a time to reflect on what you did right and wrong, and what you will improve on next year. Don’t beat yourself up if you didn’t have eye-popping returns this year. Unless you were chock full of Mag 7 names and/or bought near the bottom in November and held, then your results are likely mediocre. All things are easy to do in hindsight, but less so in real-time.

Coming into this year you saw institutions offsides in tech, and we saw what happened. My sense 2024 it will be commodities and maybe you see Treasuries snap back to the downside. As usual, we will let charts, sector rotation, and sentiment be our guide.

Almost all stocks in almost all sectors are in uptrends right now.

The average stock has had an excellent few weeks. We’ve seen that from several different perspectives, like a 52-week breakout in the S&P 500 equal-weight index and nearly all stocks in the S&P 1500 being in medium-term uptrends.

Speaking to those uptrends, more than 90% of 1,500 stocks are above their 50-day moving averages. That’s an impressive feat and preceded almost universal gains in the months ahead.

What could fuel this?

Money market accounts are bursting with cash.

The last time MMF flows reverted (2009) it was a very good time to own equities and there was a “dash-out-of-cash” for 3 years.

US money market funds total AUM of ($5.87 Trillion) right now, so there is the fuel.

However, we are probably due for a healthy pullback…….

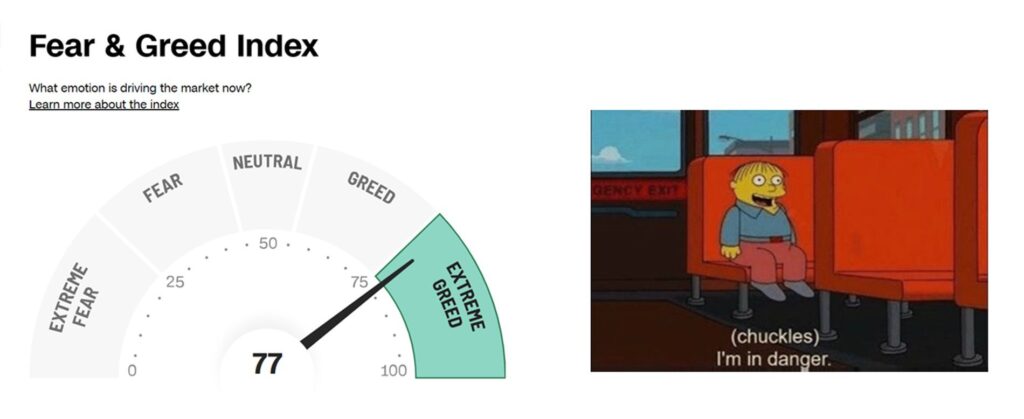

If extreme fear marked the bottom back in October, are we nearing a local top now?

We all will be spinning the wheel this year as we do every year but we love showing up. Showing up is 90% of the game and keeping losses tight is 100% of the game.

Last year I survived a couple of cancers and I don’t think I missed more than a post or two, so I do love the game and I plan on being around for a while. This casino is fascinating, and like a great golf shot, especially if you suck at golf, it keeps you coming back. Every day is different and a new challenge.

I’m looking forward to the new year and introducing some new things I encourage you to email me at [email protected] if you have questions along the way.

1-I will be restarting the chat forum. I am using Discord which is on my site now, but I need to correct a few glitches over the next couple of days.

2- I will also finally start ‘Drinks with Dave and Joe” shortly. We will discuss markets, sports, economics, and good scotch.

I wish you all a very healthy and happy 2024. It’s gonna be a blast.