Dow -219.28 at 33727.34, Nasdaq -138.09 at 13492.90, S&P -33.56 at 4349.60

The stock market closed the week on a downbeat note. Ongoing consolidation efforts contributed to some of the weakness, although concerns about global growth prospects were another contributing factor. The major indices hit their best levels in the early afternoon trade as a few mega-cap stocks recovered from opening losses, yet selling picked up again to interrupt that rebound effort.

Ultimately, the major indices all closed in negative territory with losses ranging from 0.7% to 1.4%.

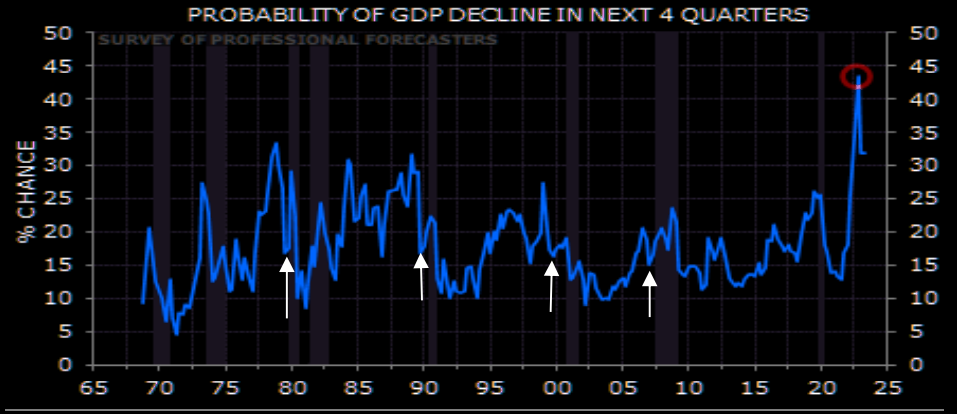

The downside moves followed a slate of disappointing preliminary June manufacturing PMIs for Japan, Germany, the UK, the eurozone, and the U.S., all of which came in below 50 (i.e. the dividing line between expansion and contraction). Following yesterday’s central bank rate hikes, those reports fueled worries that prior rate hikes may be adversely impacting economic activity, specifically in the manufacturing sector.

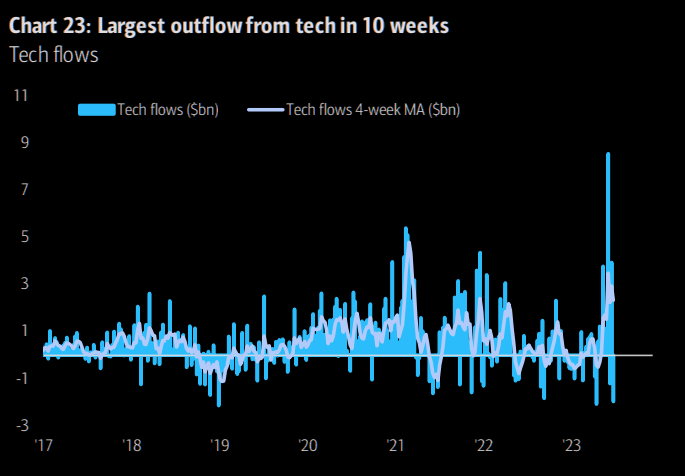

Last weekend I talked about the possibility of a rotation out of tech (big-cap tech, semiconductor, software etc). My thinking was based on rates going up again, not down.

It turns out we’ve already seen the biggest outflow in tech over the past 10 weeks. We don’t know yet if this is the beginning of a trend change out of tech or not, but worth watching.

Also, net flows into global equity funds turned negative in the week ending June 21 (-$5bn vs +$22bn in the previous week). Flows into DM and EM funds were negative on the whole. In G10, both the US and Western Europe saw net outflows.

“Economists usually give up forecasting a recession immediately before it occurs”.- Soc Gen

Artificial intelligence names were all the rage, and that helped lift some tech names. Right now they are pulling back. AI for example is down 30% in just over a week.

Keep in mind that this pullback has been very orderly with no sense of panic, which leaves the door open for some dip buying should it dip a little further.

Here are a few setups to watch.

AZEK– Triggers 27.80-28.00. Stop 26.50

– Triggers 42.25. Stop 39.75

FBIN- Triggers 68.20. Stop 66

Have a great night. Back at it in the morning.