Dow -231.07 at 33055.42, Nasdaq -160.53 at 12560.42, S&P -47.05 at 4146.85

When Saudi Arabia’s energy minister tells the shorts to “watch out” I pay attention. It will be interesting to see what these guys have up their sleeves for us in the weeks ahead.

Indexes saw a little profit-taking today. Nazzy was a little stretched especially, and we have a three-day weekend coming up and a debt ceiling issue that isn’t resolved yet.

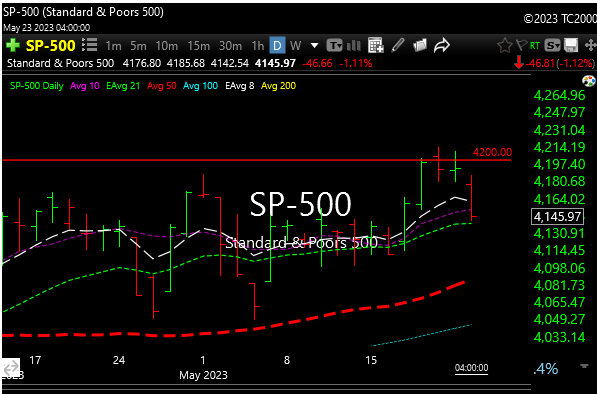

I talked about that 4200 SPX level being a big round number for the bulls to get through. It got above that level intraday on Friday and Monday but couldn’t close above, and today they took it down to close at 4145.

So SPX 4200 is still the barrier to higher prices.

Ten of the 11 S&P 500 sectors logged declines ranging from 0.3% (utilities) to 1.5% (materials). The S&P 500 energy sector (+1.0%) was alone in positive territory by the close.

Notably, regional bank stocks, which had outperformed all day, faded from higher levels seen earlier but still ended the day higher. The SPDR S&P Regional Banking ETF (KRE) rose 1.0% after being up as much as 4.0% earlier in the session.

See you in the morning.