Dow Jones: -8.8% YTD

S&P Midcap 400: -14.5% YTD

S&P 500: -19.4% YTD

Russell 2000: -21.6% YTD

Nasdaq: -33.1% YTD

The stock market had another disappointing day on Friday to close out a disappointing year. The main indices remained pinned in negative territory today amid thinner holiday trading conditions, but to be fair, pared their losses in a substantive way thanks to a rally effort in the final hour.

The initial move lower on Friday was driven by stocks seeing a reversal of Thursday’s gains with acute weakness in the mega-cap space, many of which aren’t so “mega” anymore, given the massive loss in market capitalization they have suffered this year.

On New Year’s Eve, there’s an old Irish tradition where you open your door at midnight to let the old year out and the new year in. I think 2022 deserves to have the doors, windows, and garage open.

The Santa Claus rally period, which encompasses the last five trading days of the year and the first two trading sessions of the new year, has gotten off to an uneven start. It is believed to be a good sign for how the new year will start when this period produces a cumulative gain over that stretch. 2022 was a definite exception to that belief. Recall that the 2021 Santa Claus rally produced a net gain of 1.4% for the S&P 500 and yet the S&P 500 declined 5.3% this January and 5.0% in the first quarter.

Seasonal trends can be fun to talk about but you cant always trade off it.

The January Effect

Tax-loss selling is finally over but January price action often generates a symbiotic response, popularly known as the January Effect.

Stock market investors tend to sell their biggest prior year winners in the first weeks of January, to raise cash for beaten-down value plays. Small caps are often the greatest recipients of this long-observed market phenomenon but we can add tech stocks to the list after their worst year since the 2008 market crash.

However, growth stocks may underperform for a second year in a row because the Fed’s aggressive rate trajectory is showing no signs of reaching the elusive pivot when they turn back toward rate cuts. In fact, their obsession with 2% inflation could delay that turnaround into 2024, or beyond, because we might not see that level again in our lifetimes.

Everyone will be thinking about tech stocks in early 2023, wanting to “buy the dip.” But these issues may not perform well in coming years, at least in comparison with the last decade.

Layoffs and cost-cutting are just starting in Silicon Valley and other tech-heavy locations, and getting rid of the fat could take years. That will impede growth and make it harder for these companies to maintain rapid growth trajectories.

Sectors………

Energy/Commodities

From my perch, energy and commodities still look attractive in 2023, with crude oil finding support in the $70s and natural resources becoming more scarce, due to macro and political catalysts. Commodity cycles tend to last for decades and the reawakening of inflation bodes well for metals, fuels, grains, and meats.

As energy companies’ balance sheets continue to improve, cash flow is the thing that every investor will be looking for.

Tech/Semiconductors/Software

Tech generally, but chips and software specifically still look weak to me. It’s taken 10-12 years to bring valuations to those lofty levels, so it usually takes more than a year to unwind that, so be careful and selective.

I’ve been saying for weeks that big caps like AAPL, MSFT, AMZN, and META have lower to go.

Gold/Silver

We saw a bunch of head fakes in the gold and silver miners in 2022, but they are finally starting to look like they may have some staying power. Still guilty until proven innocent, but looking much better.

Staples

This is the “safe stuff” like Kellogg, Coca-Cola, Campbell Soup, etc.

Dividends make perfect sense in the current environment, perhaps allowing these sleepy plays to book a second year of superior performance.

However, these safe havens were cheap at the start of 2022, but are quite expensive now. Remember that treasuries probably yield the same or more than some of these names now.

Crypto

They will have to lose their bowels some more for me to have any interest.

Stay off Financial TV

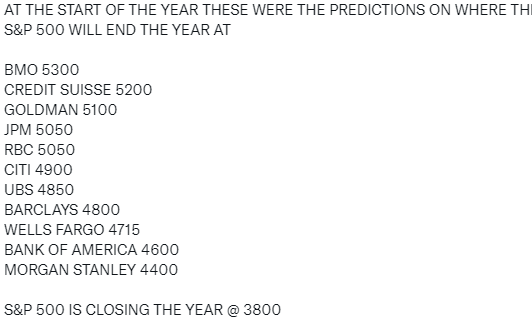

This is what the Ph.D.’s brought you last year. Hubris from the charlatans.

Biotech

Biotech (XBI, IBB) has been coiling since August. Action like that usually precedes a big move. The question is higher or lower. My gut says higher.

Medical Device Stocks

Not often talked about, (IHI) but I am seeing a ton of bullish chart setups in this space.

My final takeaway……

I see the S&P 500 discounting the ’23 earnings risk sometime in the first quarter of 2023 with a potential test of the 3000-3300 level. Recession will become a bigger worry than inflation, so the big question will be whether or not we have a soft or hard landing.

I expect to see continued “outsized” moves on the upside and downside. Should be a decent trading market though if we follow the technical levels.

Hope you had a great New Years Eve and we will be back at it in the morning.

Have a great night.