So where are we now after another crappy day?

1. weaker inflation data is bearish for stocks …This makes sense as markets contemplate what falling inflation means for growth and the equity risk premium.

2. earnings outlook is looking bad and deteriorating

3. weekly survey data falling…demand is basically worsening

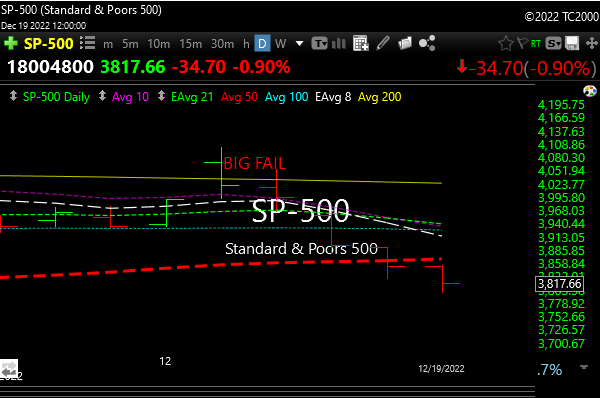

We did an overshoot of SPX 200-day moving average. A place where the CTAs were buyers, but it failed, they have now become sellers.

The big former leaders like GOOGL, AAPL, and AMZN are breaking down on the charts and look lower still. This isn’t exactly instilling confidence.

Nothing is really safe here. All sectors are getting pounded, so it’s a good time to respect the action and stay away from new longs (other than for quick trades if you’re a pro).

We are getting oversold on SPX and Nazzy, but a bounce may be just that…..a bounce. Mean reversion bounces always happen at some point.

Markets are obsessed with recession right now.

See you in the morning.

Should be a fun watch………………………. Never trust a guy who wears shorts, runs billions, and carries a deck of cards.

“SBF was dressed in a navy blue blazer with an untucked white shirt, one of his knees bouncing up & down throughout the proceeding. He spoke briefly to answer the judge’s questions and during the exchange was told by a court officer to stand up straight”