The market took a step back Monday ahead of the start of the two-day Federal Reserve meeting. But it wasn’t such a bad session for the bulls because it was an orderly decline for the stock indexes, and volume wasn’t overwhelming to the downside.

The Fed on Wednesday is widely expected to raise the fed funds rate by 75 basis points again to a range of 3.75% to 4%. But the odds for another 75-basis-point hike at the December meeting have been heading lower after a Wall Street Journal story noted that several committee members are concerned about overtightening.

A hawkish tone is still possible from the Fed, but the stock market seems to be growing more confident that aggressive rate hikes by the Fed after this week’s meeting are less likely.

We shall see.

New potential triggers ( on P&L)

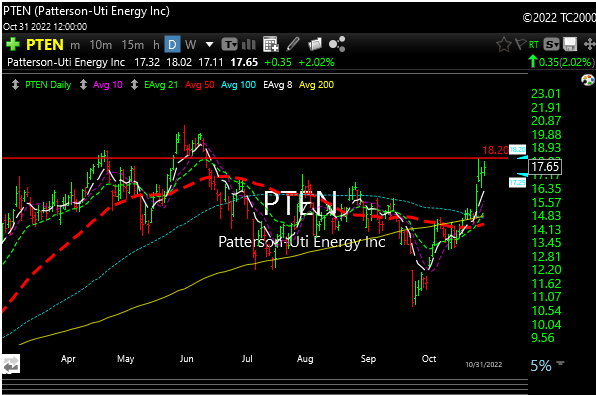

PTEN– through 18.20

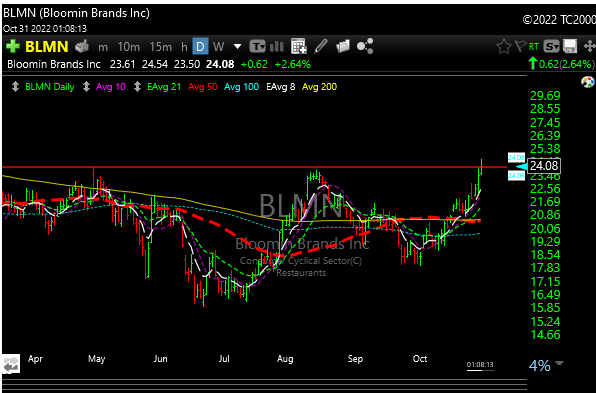

BLMN– through 24.00-24.50