Dow: -85.68…

Nasdaq: +52.42… S&P: -3.23…

The stock market was confined to a fairly narrow range today as market participants awaited the July jobs report tomorrow. Also in play was a huge stream of earnings news since yesterday’s close, a notion that the July rally was overheated given the weakening economic fundamentals and a reaction to more aggressive rate hikes from central banks.

Brazil’s central bank raised its key policy rate by 50 basis points to 13.75% and the Bank of England raised its key policy rate by 50 basis points to 1.75%. The BOE also forecast a recession in the UK starting in the fourth quarter and continuing for five quarters.

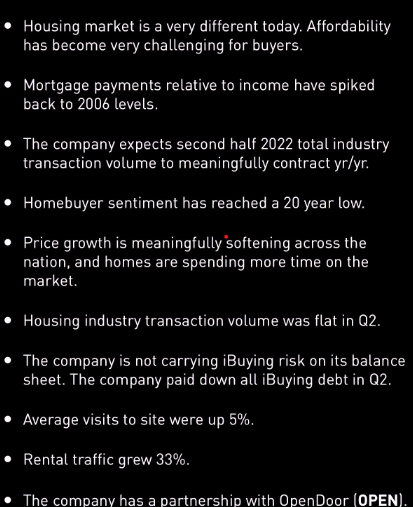

Notes from the Zillow (Z) earnings call.

Glad they have a partnership with OpenDoor. Seeing a lot of these lately.

Getting interesting…..

SPX is trading just above the big 4150 level, but the entire 4150/4200 area is basically a very important “congestion” area. Note these levels have acted as both big supports before, as well as huge resistance levels. The SPX is above the 100-day ma, but well below the 200-day ma. We are still waiting for the last overshoot. Big spot.

Fear is gone

CNN’s greed and fear index entered neutral territory yesterday. It has continued to move slightly higher and we now stand at the least fearful levels in a long time. The obvious question is: do we see greed kick in? (See last night’s post). After all, there are still many fearful people out there.

Trend followers were killing it until this latest rally. They were very short just in time for the latest melt-up. They have been covering shorts actively, but note they are just entering flat territory here. These strategies do not care about fundamentals, they chase trends. Could CTAs be the ones that get this going above 4200 and create that overshoot we have been talking about lately?

I talked about these guys (CTAs) last week and last night as well as the systemic traders……all momentum based. All algos, no emotion. Like Westworld with stocks.

These guys can push stocks around in a big way, especially with slow summer trading volumes. Right now they have been buyers, but if the worm turns they can get short in a hurry and with big size.

Ahead of Friday’s open, DraftKings (DKNG), Fluor (FLR), Goodyear Tire (GT), Leslie’s (LESL), and Western Digital (WDC) report earnings.

See you guys in the morning.