Dow: +653.61…

Nasdaq: +459.99… S&P: +107.18…

The S&P 500 rallied 2.6% on Wednesday, as buy-the-dip efforts were emboldened by a 12% drop in oil prices ($108.88, -14.88, -12.0%). The Nasdaq gained 3.6%, the Russell 2000 gained 2.7%, and the Dow gained 2.0%.

The pullback in oil was due to a confluence of factors, including hopeful-sounding rhetoric from Russia and Ukraine in front of ceasefire talks tomorrow, the UAE vouching support for OPEC to increase production, and news that U.S. officials want Venezuela to increase oil exports to the States in exchange for an ease in sanctions.

We will see what happens. This reminds me of the European crisis not that long ago when we were +800 points then -800 the next day.

The headline worked in the market’s favor today, and the bullish price action likely pulled in investors wanting to take part in a larger rebound rally. The market, however, has seen similar upswings in this corrective phase, so investors are trying to decipher if the rally is for real or if it’s just the start of another lower high.

Ceasefire talks will play a role in determining the answer to that question, as will the CPI report tomorrow and the Fed’s policy meeting next week.

If I trusted Russia I would have bought today, but I don’t, so I didn’t. I also try to avoid first-day reversals, Id rather pay up.

AMZN just announced a 20:1 split and a $10B share repurchase.

URA and CCJ caught some serious bids later in the day on news that the US is weighing sanctions on Russian nuclear supplier Rosatom. The move would impact the nuclear power industry and uranium. I sold a little in case it ends up being BS. A lot of things are BS right now.

Gold, silver, and oil all saw profit-taking.

Here are a couple of actionable ideas.

LAC– I’m no lithium expert but I know it’s exploding and the chart looks good. Buyable through this 28 level, targets 34 and 36.

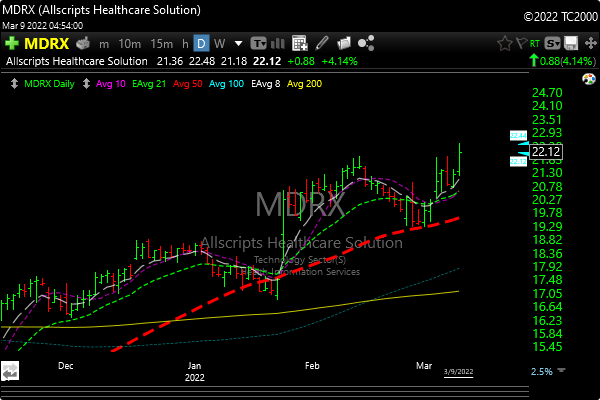

MDRX– Over the 22.25 targets 27-28.

P&L here