Dow: +92.07…

Nasdaq: +436.10… S&P: +63.20…

“It’s unbelievable how much you don’t know about the game you’ve been playing all your life.” — Mickey Mantle

If you thought today was bullish, just wait until there’s a nuclear war.

The S&P 500 dropped as much as 2.6% on Thursday after Russia invaded Ukraine, but the index ended the session up 1.5% in a buy-the-dip trade led by the mega-caps/growth stocks.

The Nasdaq rose 3.3% after being down 3.5% intraday. The Russell 2000 rose 2.6% after being down 2.6% intraday. The Dow Jones Industrial Average rose 0.3% after being down 2.6% intraday.

Initially, investors dumped risk assets and flocked into safe-haven assets like Treasuries and gold.

The Russia-Ukraine situation could still get worse, but the comeback in stock prices, the retracement in oil prices to $92.80, (had hit $100) and the decreased demand for Treasuries provided investors reasons to lighten up.

Oil gave up large early gains after President Biden said he would not target Russian energy payments with sanctions; says US will release additional barrels of oil from SPR as conditions warrant. That did a lot of good a couple of weeks ago as oil ran to $100 anyway. Ineptitude at its finest. Band-aid on cancer man.

Kicking Russia off SWIFT is the only sanction that matters. It’s why Putin reacted so forcefully to the threat. Everything else is just optics and theatrics. Putin won, so did China.

We are drowning in information but thirsting for wisdom these days.

This is where the fear-o-meter was at around 11:30 today.

I added some of the steroid etf’s today, TNA & UPRO, which I always play at extremes. If today was a bull trap then I’ll regret it tomorrow, but I think the bears may need a break so I’m Ok with the new additions. Didn’t want to go too nuts even though there were major bullish reversals all over the place. Check NVDA, MSFT, and AAPL just to name a few.

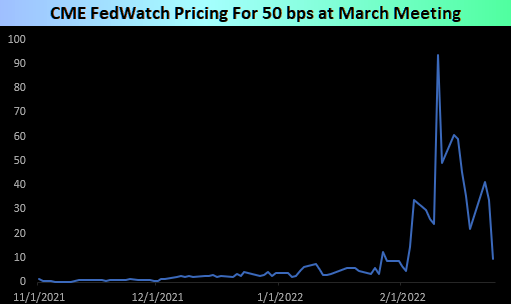

Another thing that helped the market today was the bet that the Fed will only go with a 25bp raise instead of a 50 bp raise in March.

When I saw Nazzy and ARKK green when the market was getting eviscerated it gave me a little confidence that buyers were lurking and maybe were ready to play.

Gold and silver are just so weird and I’m glad I didn’t go hog wild on longs, I still like NEM, but today both GLD and SLV put in massive bearish engulfing candles. I’m still watching closely because there could be huge upside in both, but today’s action was bearish.

Crawl before you walk and walk before you run.

The bulls have a great shot at squeezing the bears into the weekend. The bears can also do damage if they wanted to, but they may be a little spent after today.

It ain’t over yet, one day at a time. See you in the morning. Futures down about 0.5%.

P&L here