Friday

Dow: -450.02…

Nasdaq: -385.10… S&P: -84.79…

YTD

Dow Jones -5.7% YTD

S&P 500 -7.7% YTD

Russell 2000 -11.5% YTD

Nasdaq -12.0% YTD

The S&P 500 fell 1.9% on Friday, as de-risking efforts persisted amid an inclination to sell into strength, disappointing Q1 guidance from Netflix (NFLX 397.50, -110.75, -21.8%), deteriorating technical factors, and a flight to safety in Treasuries.

The Nasdaq declined 2.7%, the Dow declined 1.3%, and the Russell 2000 declined 1.8%.

Eight of the 11 S&P 500 sectors fell at least 1.0%.

Other worries in the market included what the Fed will say in next week’s policy meeting (raising 25 or 50bps?) and the Russia-Ukraine conflict that the U.S. is trying to defuse.

With COVID dying and inflation soaring, the administration (and the media) needs a new front-page story to change the narrative, so it might as well be Ukraine.

*****

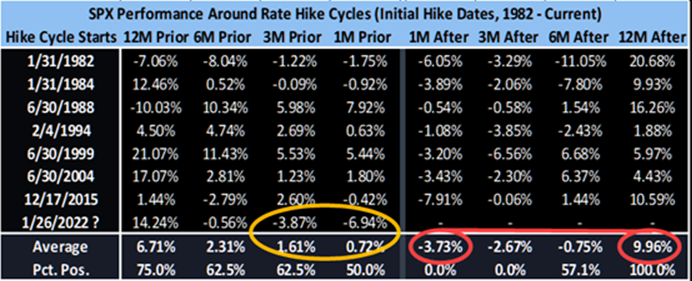

Obviously, the market has been discounting potential Fed tightening and tapering.

But the SPX has been higher 7 out of 7 times in the 12 months that followed each of the last 7 hike cycles.

Yes, we are oversold but could definitely get more oversold.

For the past decade, “smart money” commercial hedgers used stock sell-offs to go net long S&P 500 futures. Not this time. They added $25 billion to their massive net short positions last week.

It’s easier to buy the dip when the Fed is dovish and playing nicely in the sandbox. It’s harder when they are pointing a bazooka at the market.

Nasdaq’s relative strength is now as oversold as it was during the Covid Crash and on par with the 2nd move down in Dec. during the Taper Tantrum.

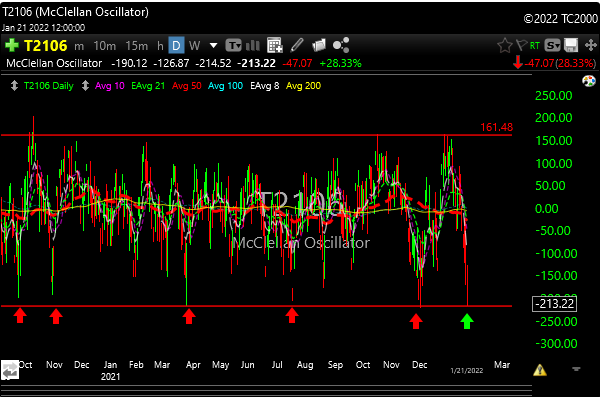

As I showed you last week, McClellan Oscillator is at that dependable “buy spot”, but we may not see any kind of rally next week (if we do at all), until after the Fed speaks.

AAPL and TSLA report next week as well as many other companies. Those that miss will be taken apart, those that beat and raise guidance should be rewarded.

Yes, there is inflation, but your dollar buys twice as much ARKK fund as it did a year ago. Other stocks too.

I showed you SARK a month ago. The new ETF that gets you short ARKK.

COVID meltdowns are good to see..

The bright spot is that Covid will hopefully be a thing of the past soon. Don’t think so? Look at the performance of the vaccine-related stocks.

Testing stocks: ABT, BDX, DGX, FLDM, HOLX, LH, PKI, QDEL

Vaccine stocks: MRNA, BNTX, PFE, NVAX

Fortunes made……fortunes lost.

Crypto

Dead for now.

Indexes

All the key indexes did their best effort to crash and puke last week as they are all now below their 200-day moving averages. The 200 day is usually big support because the 21,50, and 100-day moving averages have all been violated.

This could be a great setup for a massive rally, not sure how long it will last because rallies keep getting sold, but there will be an opportunity. Hedge funds are very short. This will be a big week I think.

At market extremes, I usually play the leveraged long ETF’s because they can be easy money for a few days when the worm turns.

ETF’s like SOXL (chips), TNA (Russell), UPRO (SPX)-we just took a round trip on this one), and Nazzy (TQQQ). These are all 3X leveraged long etf’s. DDM gets you 2X long the Dow.

Not sure where we will get our opening but will do my best to let you know.

See you in the morning.

P&L here.