Dow: -313.26…

Nasdaq: -186.23… S&P: -50.03…

The S&P 500 declined 1.1% today in another disappointing session, as investors doubled down on the inclination to sell into strength. The S&P faded a 1.5% gain and closed the session down 7.0% from its all-time high.

The Nasdaq fell 1.3% after being up 2.1% intraday. The Dow fell 0.9% after being up 1.3% intraday. The Russell 2000 fell 1.9% after being up 2.0% intraday.

Ten of the 11 S&P 500 sectors closed lower after all 11 traded in positive territory in the morning.

We talked about support levels last night. NDX broke the 200-day moving average today, SPX broke that double bottom I showed you last night, Dow broke the 200-day moving average and the Russell is just in free fall right now.

It will find a bottom but this action is horrible. Every rally gets sold. January has only put in 3 green days so far, with all bounces being sold.

You could argue whether or not this is bear market action or just a hard pullback. You never really know until it ends. It depends on what the bulls do and when. What will they buy? Back to tech, which is getting destroyed, or gold, silver, and commodities? Will the latter be the theme for 2022?

Charts that looked great last week have failed. Charts and stocks that looked great just this morning puked and went red by the close.

We hit stops on BTU (to the penny), had 20% in that one, and SLCA today. You can always give wiggle room to stops but when I see what looks like liquidations (not normal selling happening) I take stops. BTU has support at the 11.70 level if you are still holding. I love the name and will buy t back once it levels.

Netflix is down $110 points as I write (-21.0%). Nothing is safe right now and missteps get brutally punished.

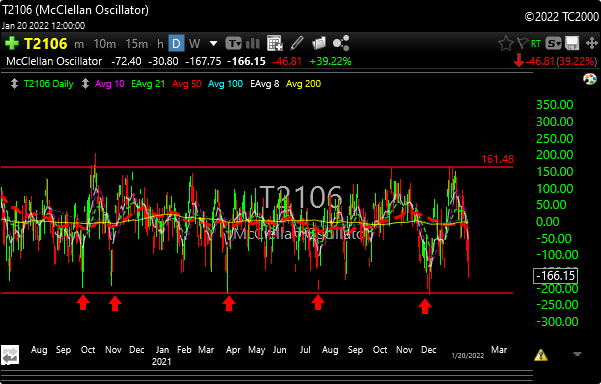

McClellan Oscillator approaching buy zone, also posted last night. If it breaks though, we may have bigger problems than we thought.

See you in the morning.

P&L here