Dow: +305.10…

Nasdaq: +180.92… S&P: +45.76…

Strong: Information Technology, Health Care, Real Estate

Weak: Energy, Financials

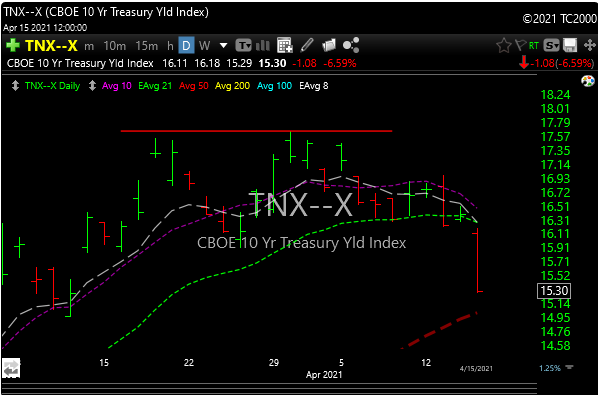

We thought that if treasury yields cracked it would help stocks. Well there you go.

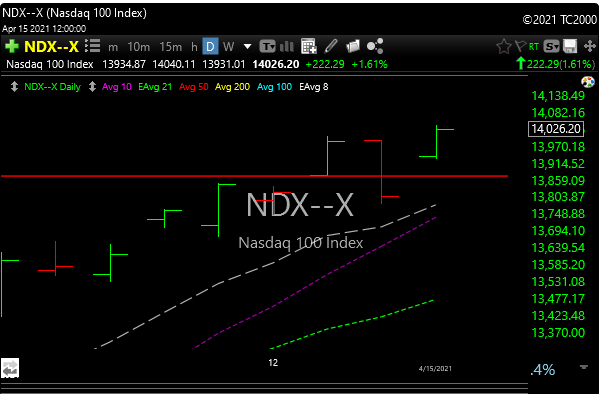

The S&P 500 (+1.1%), Dow (+0.9%), and Nasdaq 100 (+1.6%) set intraday and closing record highs on Thursday, as the 10-yr yield dropped 11 basis points to 1.53% despite a batch of better-than-expected economic data. The Nasdaq rose 1.3%. The Russell 2000 increased just 0.4%.

Prior to the open, retail sales soared 9.8% m/m in March , weekly initial claims dropped by 193,000 to 576,000.

That big negative Nasdaq reversal yesterday turned out to be a head fake that just sucked in some shorts. Today it took out new highs.

Interesting to note that the banks, which had off the chart good earnings yesterday, held gains today even though rates dove. Banks hate falling rates.

The metals have been better, and gold and silver had a good day. GLD closed above its 50-day moving average and SLV is just pennies under its 50-day MA. There have been a bunch of head fakes in the metals but they look a lot better. When you give up on a sector, Wall St. can come back to it, so we need to keep our eyes on the sector.

If this is the beginning of a real move, as usual, I like SIL and AGQ in silver, and GDX in gold which we own.

AA reported a great # after the close so this could bode well for names like CENX, FCX, X, ATI, and CLF which all have great charts.

Energy (XLE) took a breather today, but I just looked at 50 oil stocks today and they all seem to be coiling bullishly so there could be a trade here. I will probably play it with ERX (2X the XLE) and I will let you know tomorrow or the next day.

I need to get this bullet train back on the tracks and I’m looking at a lot of names. Here are a few.

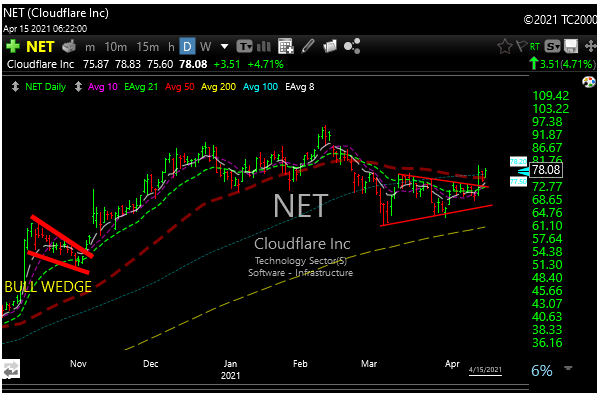

NET- looks interesting. It popped big yesterday on big volume as they announced a big artificial intelligence deal with NVDA. The stock is flagging and looks like 85 could be the first target. Today it closed just above its 50-day.

CELH– This one was highlighted in the weekend post this past week or the week before. Still setting up beautifully. Targets 63-66.

MARA- might be worth a look here. It pulled back with RIOT, but did a good job of holding the rising trendline and the 50-day moving average. If this little pullback is indeed over, there could be a quick $10 in this one. Should be fine as long as it doesn’t break the 50-day ma.

CENX– is in the right space (aluminum) and is setting up. Looking for 20.

David Einhorn released his quarterly report to investors today. I think he was down 0.3% for the quarter VS. +6.0% for the SPX. Anyway, it was an interesting read. Below is a snippet.

I need to by a deli. Fun times.

Strange things happen to all kinds of stocks. Last year, on one day in June, the stocks of about a dozen bankrupt companies roughly doubled on enormous volume. Recently, the Wall Street Journal reported a boom in penny stocks.5 Someone pointed us to Hometown International (HWIN), which owns a single deli in rural New Jersey. The deli had $21,772 in sales in 2019 and only $13,976 in 2020, as it was closed due to COVID from March to September. HWIN reached a market cap of $113 million on February 8. The largest shareholder is also the CEO/CFO/Treasurer and a Director, who also happens to be the wrestling coach of the high school next door to the deli. The pastrami must be amazing. Small investors who get sucked into these situations are likely to be harmed eventually, yet the regulators – who are supposed to be protecting investors – appear to be neither present nor curious. From a traditional perspective, the market is fractured and possibly in the process of breaking completely. Another recent example is the investigation of Tether by the Office of the Attorney General of New York (OAG). Tether is a cryptocurrency that is always worth a dollar (the value is “tethered” to the dollar). Tether is one of the largest cryptocurrencies with about $40 billion outstanding, yet it has not been audited or regulated in any serious manner. In theory, Tether is supposed to have $1 of cash backing every Tether issued. Except it didn’t, at least when it was investigated. The OAG conducted a two-year probe and found that Tether deceived clients and the market by overstating reserves and hiding approximately $850 million of losses around the globe. Tether and its sponsor, Bitfinex, “recklessly and unlawfully covered up massive financial losses to keep their scheme going and protect their bottom lines,” said the OAG. Further, “Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie.”6 Did the OAG shut down Tether? Did anyone get arrested or even lose their job? Was the regulatory infrastructure changed to make sure this doesn’t happen again? No, of course not. The OAG assessed an $18.5 million penalty and Tether agreed to discontinue “any trading activity with New Yorkers.” It was as if Bernie Madoff had been told to pay a small fine and stop ripping off New Yorkers, but to go ahead and have fun with the Palm Beach crowd.