I thought this was hilarious

Dow: +306.14…

Nasdaq: -310.99… S&P: -20.59…

They kind of laid a bull trap on the Nazzy didn’t they? Friday looked good, the move looked and felt real, but then they didn’t waste any time selling the rip today. The SPX also faded fast as it topped out after lunch.

The Dow was fine+300 and the Russell was +1.0%

They hate tech right now, the large-cap growth names like AAPL, AMZN, FB, and MSFT all have looked heavy of late.

Seven of the 11 S&P 500 sectors closed in positive territory, but it was hard to overcome the continued growth-stock weakness within the information technology (-2.5%), and communication services (-1.5%).

The financials (+1.3%), materials (+1.3%), and industrials (+1.1%) sectors represented the cyclical leadership.

The Kathy Wood genre of stocks went back into the woodchipper and someone told me she was on CNBC talking her book and waxing all kinds of positive. If Ms. Wood can turn the 10-year treasury, maybe she’ll have a shot for a rally. ARK funds were down 4-6%.

The semiconductors (SMH) got hammered like a nail today down 5.2%. SMH closed right on its 100-day moving average. Software (IGV) was down 3%.

For now, tech has gone from being the only place to be, to the place not to be.

The crazy names were back today. Last week I noted that GME actually had one of the best-looking charts out there, even after all the madness. Today it popped 41%. Old meme faves like EXPR (+48%), AMC (+12.5%), and BBBY (+10.0%) all jumped back in the sandbox and had a blast.

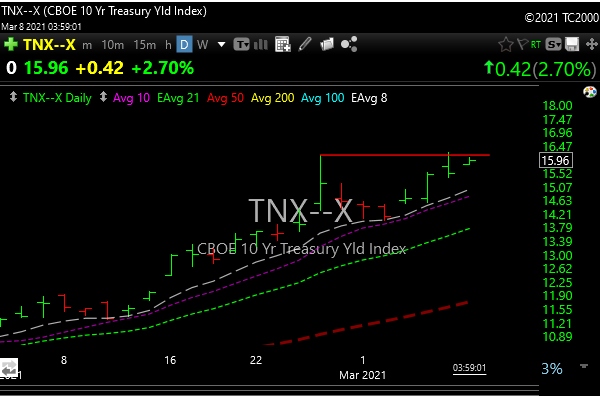

David Tepper was out this morning commenting that he thought treasury rates might be close to topping out short term. That helped the market for a while, but rates hung tough and bids for stocks left the building.

I’m still watching this possible double top on the 10-year yield. Stocks will like it if this hits resistance and breaks lower, but if it breaks above and gets momentum higher then stocks are going to have more problems.

As far as the SPX goes, the 3820 level (we’re right on it) is a key spot for the bulls to defend. If we lose that, then 3770 could be tested quickly.

X popped 13.5% today and that was the only bright spot.