Dow: -167.09…

Nasdaq: -24.79… S&P: -17.38…

The S&P 500 declined 0.5% today in a cool-down session following its recent record-setting run. The Nasdaq (-0.2%) and Dow (-0.6%) also closed modestly lower, while the Russell 2000 (+0.4%) closed at a fresh record high.

It took the Russell two years to lay catch up and now it’s leading. Big cap tech is taking a back seat to small-cap growth right now. It’s all part of the mini rotations that we sometimes see.

Bitcoin is up 60 percent in the past month alone. This performance makes it the best-performing macro asset, hands down.

It’s no surprise that considering this performance, investors want in. While retail interest in the cryptocurrency market has yet to really pick up as BTC is not yet past its $20,000 all-time high.

One of the “analysts” at Citi came out with a $300,000 target on Bitcoin yesterday. He was probably ingesting magic mushrooms and purple microdot at the time, but hey, who hasn’t?

GBTX, the ETF for Bitcoin as been stellar.

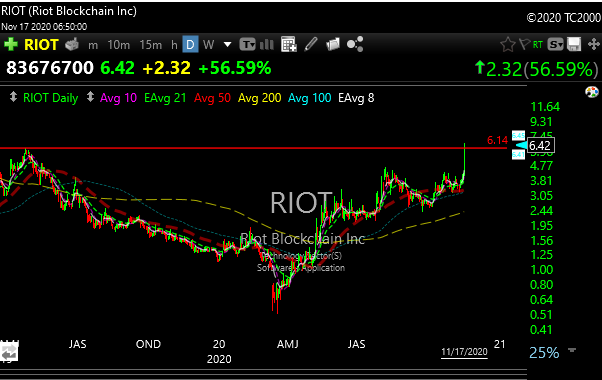

Smaller crypto stocks went bat shit crazy today.

MARA

RIOT & MARA are your Robinhood trader favorites. The Robinhooders have been good in this market, but it makes you question if we are getting overheated.

I’ve said that I think Bitcoin is here to stay in a big way, now the smaller players are jumping in the pool.

So crypto is back in play. How about electric cars?

We caught NIO nicely, but have you seen KNDI and FSR.? All of these charts look phenomenal. Most end in tears, but for now, they have momentum.

By the way, NIO reported after the close and they beat and guided higher.

They say the crazy stocks get hot at market tops. We will surely find out.

We’ve covered crypto and electric cars, how about some weed? Oregon just decriminalized cocaine but plastic straws are illegal. That must be frustrating.

We are long MJ, the ETF for marijuana. I like it still, and the charts within this etf are starting to develop.

Individual names that look good in the weed space are CGC, CRON, APHA, GWPH, and TPB.

Those are individual plays, I’m comfortable owning the ETF because I am diversified and it eliminates individual company risk.

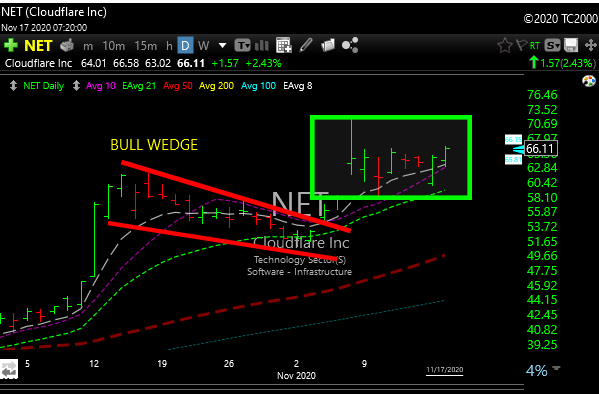

I peeled off QLD and SMAR today and added NET as a new long.

NET looks higher. I have targets of 75 and 80.

After the massive breakout of that bullish falling wedge (red lines) its now in a bullish consolidation box in green.

Current P&L here because many new members don’t know that we have a P&L I guess.