- Nasdaq Composite +31.8% YTD

- S&P 500 +11.0% YTD

- Russell 2000 +4.5% YTD

- Dow Jones Industrial Average +3.3% YTD

The S&P (+1.4%) and Russell 2000 (+2.1%) closed at new record highs on Friday, as cyclical and small-cap stocks claimed the new leadership roles in this part of the bull market. The Dow gained 1.4%, and the Nasdaq gained 1.0%.

The gains were broad and steady with all 11 S&P 500 sectors opening and closing in positive territory. Sector gains ranged from 0.9% (utilities) to 3.8% (energy), and all 30 Dow components also finished higher. The industrials (+2.2%) and real estate (+2.3%) sectors were other standouts.

As we make or approach all-time highs, the market doesn’t look overbought if you look at the McClellan Oscillator (my favorite overbought/oversold indicator), and the technicals on the indexes aren’t stretched.

That opinion is based on technicals, we all know that we can be a heartbeat away from a headline that can muck it all up.

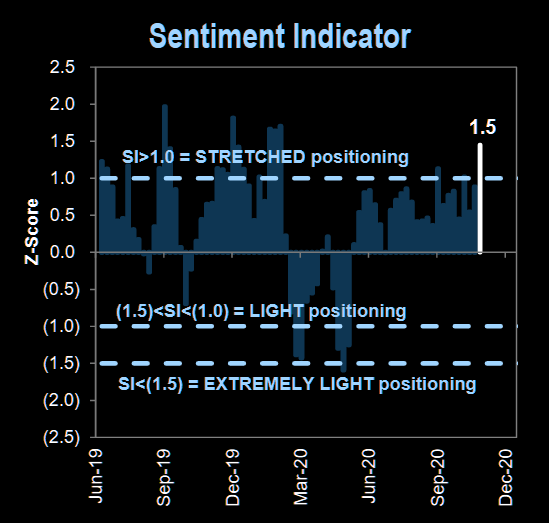

However, GS thinks we are back to stretched. I show this chart every Sunday.

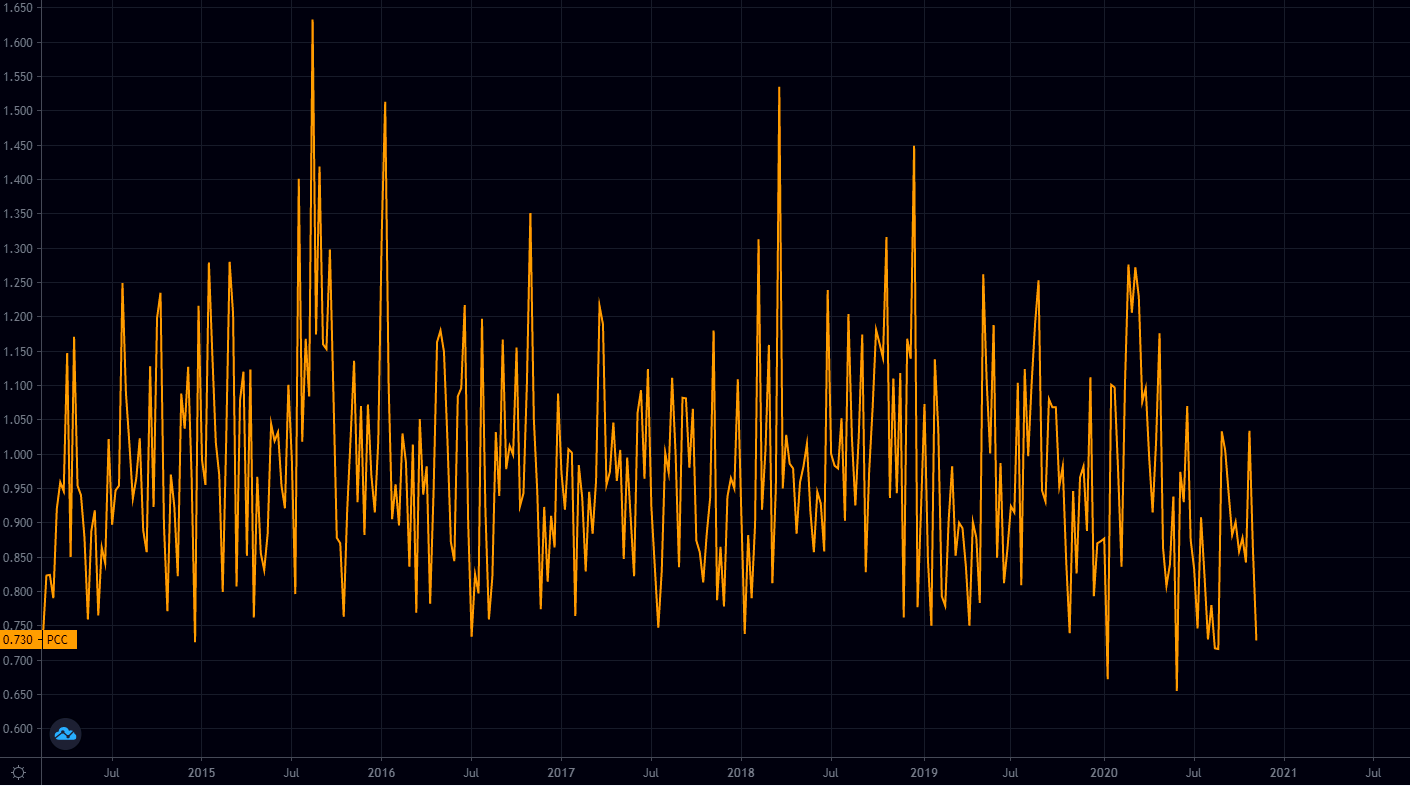

The market is back to hating puts again. Seems every time they hate puts, they should really be long puts and loving puts.

Now, what really could get this party going is if the quant nerds get greedy and start moving in. They run size and the hotter the party gets the more dollars they will contribute

1. As of Fridays close, GS systematic strats team forecasts +$25B worth of equity demand over the next week in a flat tape and +$37B worth of equity demand over the next week in an “up modest scenario”.

2. As of Fridays close, GS systematic strats team forecasts +$69B worth of equity demand over the next month in a flat tape and +$137B worth of equity demand over the next month in an “up modest scenario”.

However, NDR Daily Trading Sentiment is now printing a 64 reading – up from 50 from the last reading. Anything above 62.5 is considered as a selling opportunity into excessive optimism, and has decent actual returns (ie neg performance).

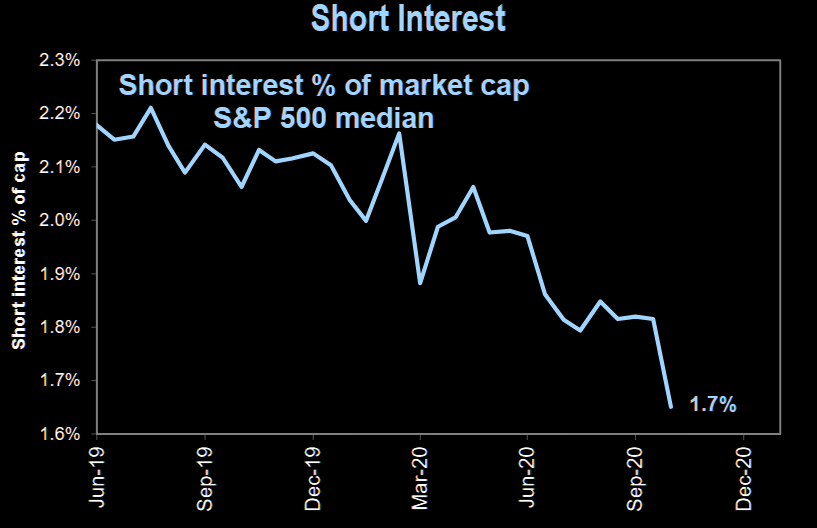

Short interest keeps collapsing, printing a new significant low this week. Wonder if short interest has ever been this low vs VIX?

Rest-assured, shorts will come back in vogue again. When short interest gets this ridiculously low it’s not a bad idea to look at some shorts or at the very least hedge some positions.

I showed this chart last week. SPX was “in the box” and was either going to breakout or fail. It broke out Monday than pretty much gave it all back and closed on the low of the day. It managed to make a new all-time high by Friday.

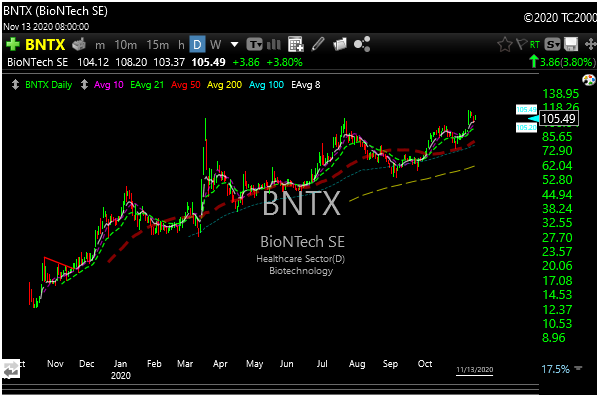

Pfizer and BNTX worked together for this COVID vaccine. I remember a year ago BNTX had to lower its IPO price from $20 to $15 because of a lack of demand.

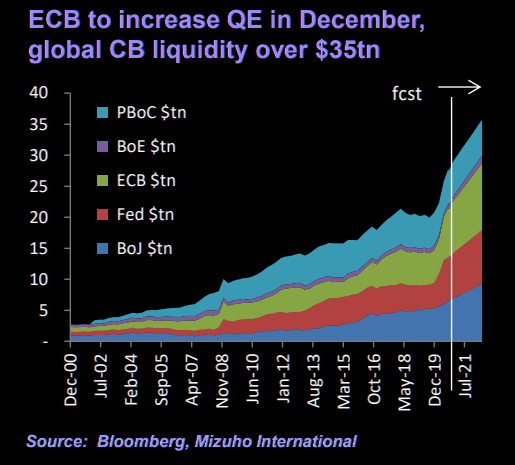

Looks like the central bankers are predicted to keep printing. This cant be bad for gold and silver.

Every time energy (XLE) teases you into thinking it can make you some money, it turns around and shoots you in the face.

But you have to respect the energy sector chart below, that was a huge downtrend line breakout on massive volume on Monday. Now it’s in a bull flag. I’m looking at some oil patch opportunities.

As always there are so many differing opinions on where this market will go short term.

Last week, inflows into equity funds printed a 100-week high. A perfect storm in terms of fund inflows brewing? The retail army will be needed to really create the year-end melt-up, as hedge funds are already “all in”.

Here are the watchlist names for this week. As always, more will develop as the week progresses.

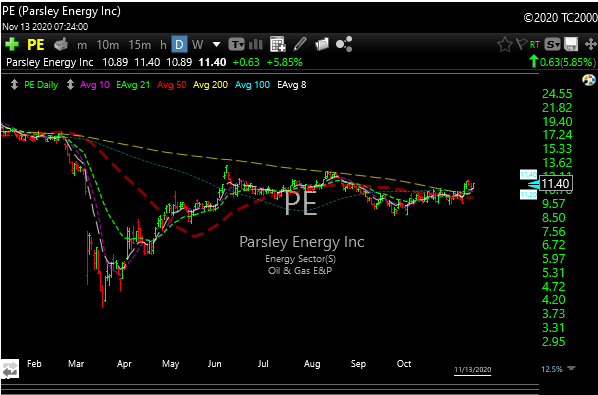

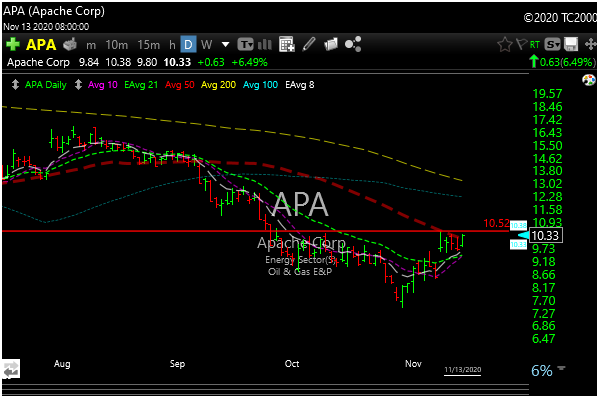

I will start with 2 oil names in case this move is real.

PE– Really nice little base/coil now bull flagging. 12.50-13.50 targets.

APA– Seems like yesterday I asked the question here, “how can you not buy APA at 4.50?” It was a watchlist name back in April. I never added to P&L. It went to $17, then energy got crushed again. Anyway, it’s setting up again with a bull flag and good technicals. 12.75-14.00 potential targets.

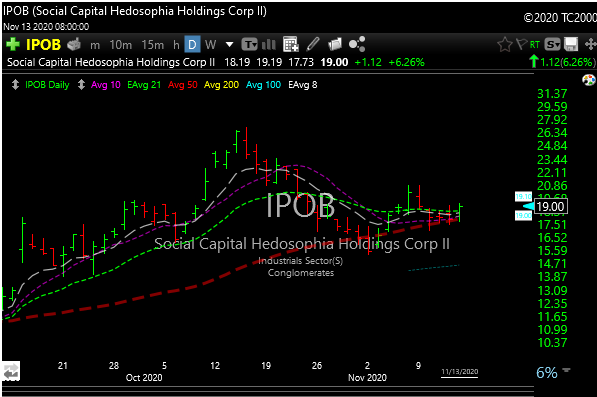

IPOB– A recent SPAC getting institutional interest. 21-24 targets.

PLTR– Recent IPO that’s flagging, would love to get it at 13.50-14.50, but a move through 16.75 could get it going to 19-20.

See you in the morning.