- Nasdaq Composite +21.0% YTD

- S&P 500 +3.4% YTD

- Dow Jones Industrial Average -3.1% YTD

- Russell 2000 -10.3% YTD

Still a little early to go dip buying for me but that could change tomorrow.

The SPX and DOW managed to close green on Friday, but the Nazzy continued to see pressure as tech saw some more pressure.

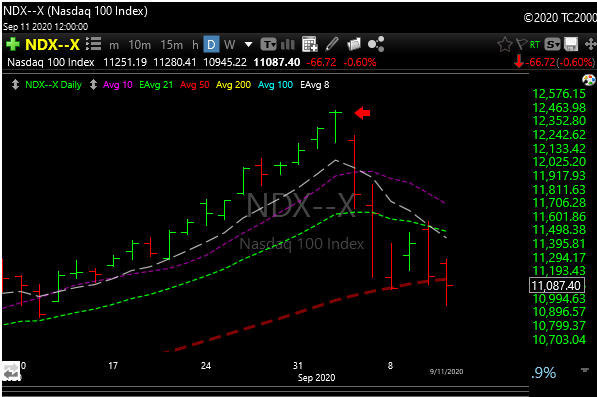

The Nazzy closed below its 50-day moving average on Friday after holding its 21-day moving average since April, so it knocked out two key moving averages last week.

That still doesn’t concern me much. The overthrow of the 50-day ma. may end up being very temporary. Many times they overthrow moving average support, suck in the shorts, then rip it to the upside. So tomorrow could be a key day.

The software (IGV) and chip (SMH) names have come down hard and fast as well as infotech (VGT) and internet-related names (FDN).

In software, a stock like Fastly (FSLY) was telegraphing some negativity even before the tech rollover. This was a tech darling and could be again, but it’s been getting hit hard.

After breaking down in early August, it broke an ugly bear flag that developed last week.

I’m seeing a lot of short candidates in this space that could resolve the same way, unless this group can catch a rebound soon and turn it around.

Silver and gold are still consolidating and didn’t make any noise last week.

GLD

There is a ton of economic data this week, but the big kahuna will be the Fed on Wednesday. More dovishness, or will they telegraph some hawkishness? Either way, it should have major implications for gold, silver, and the overall market.

See you in the morning.