Dow: -807.77…

Nasdaq: -598.34… S&P: -125.78..

The S&P 500 dropped 3.5% today in an orderly retreat led by the mega-caps and growth stocks. The Nasdaq underperformed with a 5.0% decline due to its greater exposure to these names, while the Dow (-2.8%) and Russell 2000 (-3.0%) declined about 3%.

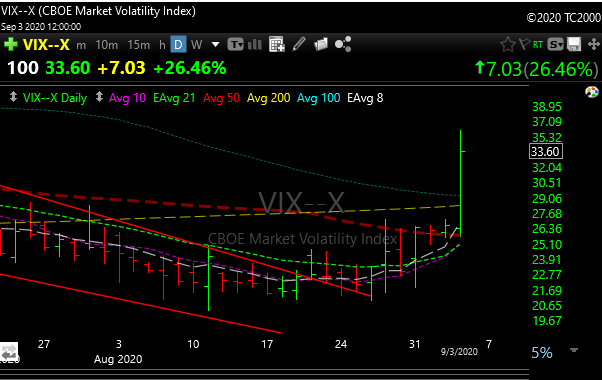

VIX was up 26% today. UVXY the same. Buy protection when you can, not when you have to.

It was a tech wreck today but long overdue. We all talk about the FAANMG stocks, but the new acronym in town would be TAZ, Tesla, Apple, and Zoom.

I mention TSLA because it has been trading in la la land for a very long time. It’s funny how TSLA and AAPL collapsed after their big splits.

If you follow the thinking that a 20% pullback means a bear market then TSLA is just about in a bear market after seeing almost a 100 point drop in three days. ZM has also dropped a quick hundo in three days.

AAPL printed a bearish engulfing bar yesterday that wasn’t bullish. It now finds itself just above its 21-day moving average.

I still think there will be a big appetite for stocks until rates go even lower, the Fed prints even more, and then the whole thing gets carried out on a stretcher that will be worse than what we saw in March.

The market is closed Monday so I’m not sure how aggressive the “buy the dippers” will be in front of that, but you just never know.

That Nazzy close yesterday was perfection, but then the gap down this morning made it hard to short the hole and it just ended up being a trend down day. Usually, the lights go out when you see a print like that, even though it closed on the highs. Shoulda woulda coulda.

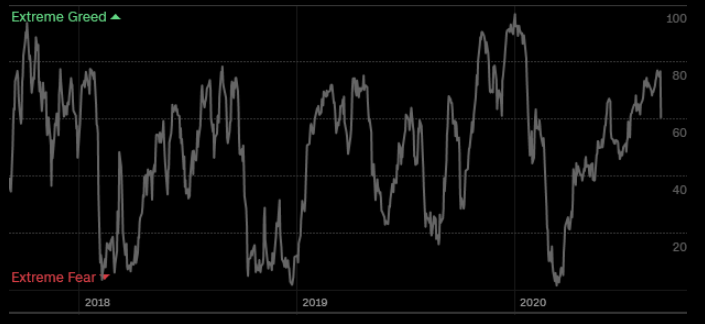

Extreme greed dropped after today.

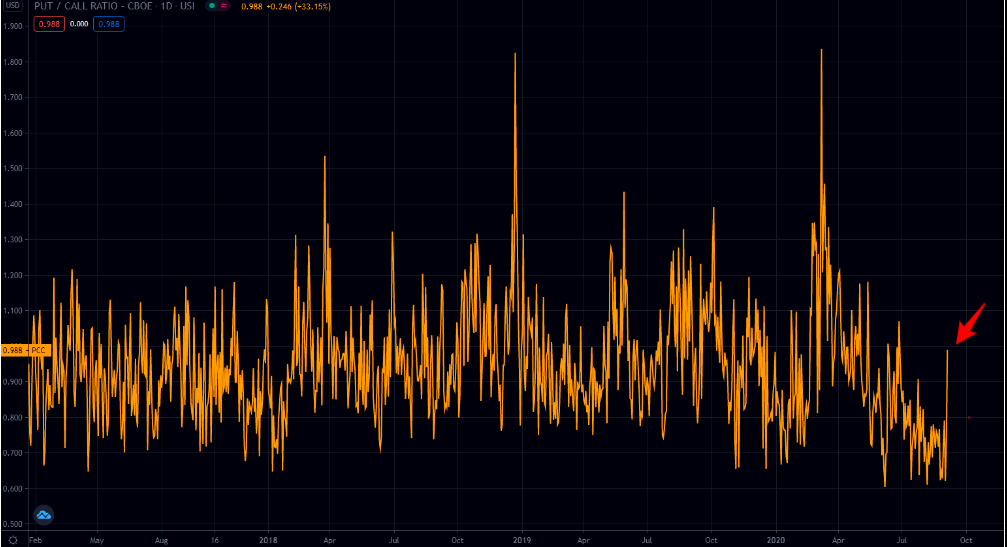

Once again, the masses hated puts right at the highs again.

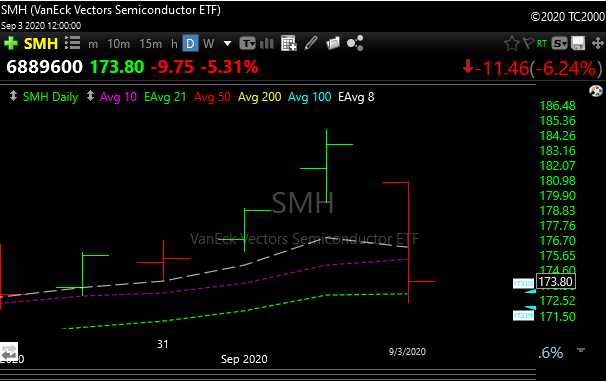

Today might have been it, maybe not, but the daily charts are still intact and if you look at the chips (SMH) as an example, the 21-day moving average held today. Similar to the Nazzy, the chips have held that moving average for quite a while so that’s a key level to watch.

Time to get out the scratch sheet and find some names. Feel better here than having chased.

I told you a night or two ago that the hedgies were all jammed in the phone booth …all long to the gills. Never ends well. As I said, contrarians love that kind of stuff.

Risk managers may have their work cut out for them tomorrow if too many of their chasing hedge fund traders got too long at the top. Could mean some more selling, we’ll see.

Things happen so fast in this market its hard to set up short sometimes.

See you in the morning.