Dow: +185.46…

Nasdaq: +109.67… S&P: +21.39…

This market is adorable when it comes to earnings. For the last couple of weeks, all I see is “XYZ company beats earnings”. Then I read more and I see something like this……

XYZ lost $4.00 last quarter (massive loss), but the estimate was to lose $5. Boom, stocks pops 5-10%. It’s laughable. But it beat right?

The earnings bar is so low, because things are so bad that companies are being rewrded big time for just losing less money.

Yes, I know the market is the perfect discounting machine and it’s looking forward, but to reward company after company because of this is outright ridiculous.

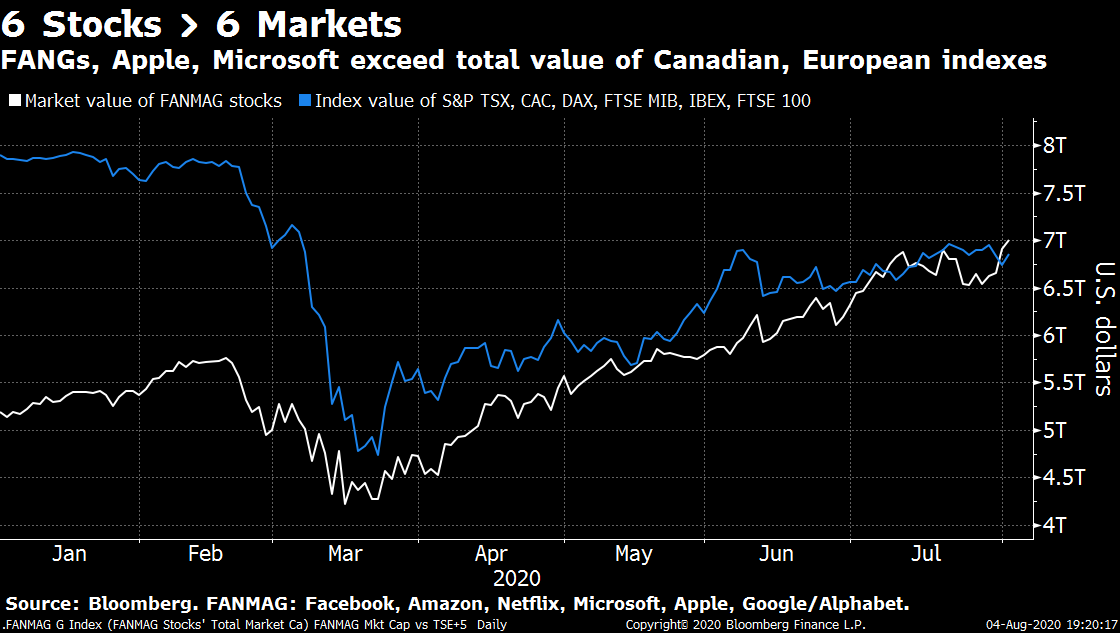

In other news, the five largest US stocks–FB, AMZN, AAPL, MSFT, and GOOGL — now account for 22% of S&P 500 market cap and trade at a 70% P/E premium to the other 495 S&P 500 constituents (31x vs. 18x) – the largest premium in 20 years.

The FAAMG stocks, Apple and Microsoft add up to $7 trillion of market value — more than the S&P TSX, CAC 40, DAX, FTSE, MIB, IBEX 35, and FTSE 100 combined. BONKERS.

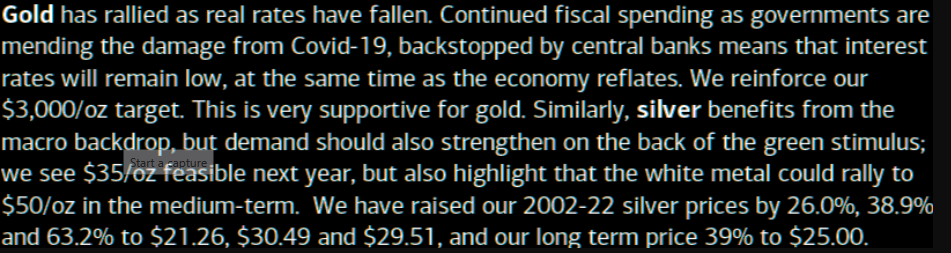

From Morgan on gold and silver….. $3000 & $50

Silver was up almost 8.0% today by the way. Weekly chart below.

The massive stimulus is coming on top of pending monetary insanity on steroids, i.e.MMT or helicopter money, and it’s GLOBAL.

This will all end in tears at some point and to reiterate my point of a week ago, the March crash will look like choir practice when the chickens come home to roost on this one.

Karma is a bitch.

I wont expect a V recovery like we saw in March on the next one either.

The politicians are making these calls right now and they are so inept and so stupid that they would climb a glass wall to see what’s on the other side.

Yet I digress.

I added GBTC and JETS today.

GBTC– broke out of a year-long downtrend this week and the volume was excellent. Let’s hope this one gets some momentum over the next few weeks.

Have a great night.