Dow: +10.50…

Nasdaq: -226.50… S&P: -29.82…

Dow: +10.50…

Nasdaq: -226.50… S&P: -29.82…

Happens every time. I started a five-hour drive at around 1:30 today and the market pukes and implodes after a lovely morning. As you can see in the chart above the SPX hit some key lateral resistance and decided to screw the pooch.

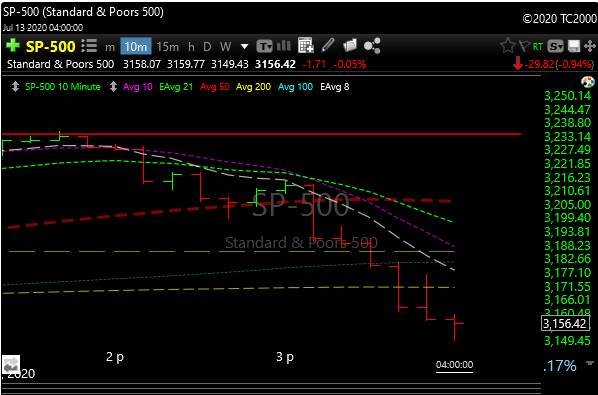

Here’s a 10-minute chart of when the selling started and how it accelerated.

The S&P advanced as much as 1.6% on today, but a combo-platter of negative-sounding headlines caused noticeable profit taking in many of the technology-related stocks that left the SPX down 0.9% for the day. The Nasdaq fell 2.1%, and Russell 2000 fell 1.3%. The Dow (+0.04%) eked out a tiny gain.

The day started in rally mode with the FAANG stocks hitting fresh all-time highs and health care stocks outperforming after two COVID-19 vaccine candidates received fast-track designation from the FDA.

The FAANMG stocks make up 23% of the market cap of the entire S&P 500. Common sense would tell you that these 5-6 stocks need to do well almost on a daily basis. Let that sink in.

After the S&P topped out at the 3235.28 level at around 1:40 p.m. ET, the Treasury Budget for June revealed a record $864.1 billion deficit, the Los Angeles and San Diego Unified School Districts announced that the new school year will start remotely, and Secretary of State Pompeo confirmed the U.S. will strengthen its policy on China’s territorial claims in the South China Sea.

Losses accelerated, taking the market into negative territory after California Governor Newsom announced all counties have to re-close indoor operations in several business sectors due to the coronavirus. In addition, the inability of the S&P 500 to stay above its June 8 closing level (3232.39) likely contributed to the downwards momentum.

COVID headlines are really getting traction again and the market might be getting out of the way in case there is a Phase 2 COVID attack.

This could get really ugly in a hurry if it does. There were some pretty ominous bearish engulfing bars on the daily charts today, (stocks, etf’s, and indexes too). That’s not necessarily a death sentence for stocks, but it will depend on the bulls stepping up to buy the dip or we could see a situation like early June where we lose a few hundred SPX points just to let some air out.

For example, NFLX and AMZN received huge price upgrades on Friday, but both reversed violently today to close near the lows of the day.

Software (IGV) was finally hammered by about 3.5%, semiconductors (SMH) -1.1%, but lost a big gain, Internets (FDN) and info tech (VGT) all were tech sectors that saw substantial bearish reversals.

This market is still running on the Fed, so that story is still intact, and so far the market has done a good job of ignoring more negative COVID news, so we could know by tomorrow if today was just a “one-off” or the start of something more.

It was interesting that VIX and VXN have been “up” on up days for the market lately. This morning, both were very green again with the SPX and Nazzy running green. It was a pretty good “tell”.

It’s always interesting. Let’s see who takes the hill tomorrow.