That’s not a clickbait title, this is a private post to premium members, so no one sees it but you, but at some point, the Fed could step up and buy equities.

They are greasing the skids. They are at the point of no return.

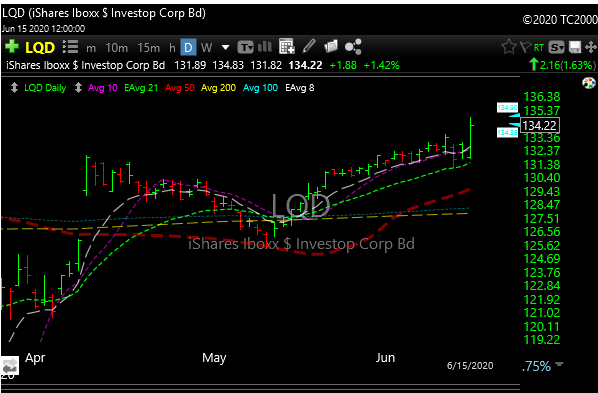

The Fed waited for the LQD gap to be filled, as weak hands puked the front running trades.

Some 10 days into May, Fed started buying LQD. Add to that the huge break out we saw in LQD today.

Perfect timing by the world’s biggest prop trader, Chairman Powell.

The market knew the Fed would be buying HYG and LQD and their ilk so they did a nice front run that started at the end of March. It pulled back and the Fed today announced they would buy all things in the corporate bond world.

Here’s a better look at the LQD breakout today. All ginned up by Fed liquidity.

Hang in there, the Fed may step up and buy your house, your car, and your stocks soon.

Every hedge fund manager that has billions of corporate bonds in the pot is doing jello shots with strippers after today. They get 2 and 20 and life just couldn’t get better. The movie is Avatar and they rule Pandora with no risk.

What has played out over past months is a great mix of emotions and complex psychological set ups for most. Most were shaken out at lows, married the bearish “fundamental” story, bought protection too late, shorted some more only to see everything squeeze higher.

Whatever view you have of markets here does not matter. One should stick with positions you have a “conviction” in, but sticking to conviction ideas is maybe valid when it comes to long term investing, not so much in trading.

Let your p/l dictate the amount of risk you are deploying.

Stan Drunkenlnmiller, the greatest investor of all time, in my opinion, is up 3% for the year. He was quoted the other day as saying “I underestimated the Fed”. This is a guy who has lunch with Fed members for Christ’s sake.

Stan’s biggest long in years was a deep position in the Russell in the fourth quarter of 2019. The market topped and crashed in Feb 20, IWM went from 168 to 96. He wishes he had that long position back.

Back before the tech bubble crashed in 2000, he bet $6 billion on tech stocks, within two months it was worth $3 billion. He said it was the biggest mistake he ever made. He still made money that year.

Even the best are late, even the best get fooled.

I ramble on here because this is that kind of market. Anything could happen at any point, now more than I have ever seen before.

If you look at where the futures were at 3 AM this morning and look at where we closed, it’s almost unfathomable.

We go from “its the beginning of the end” again… to massive reversals. RobinHood traders who wear braces are outperforming Drunkenmiller by a huge margin. I see this and I know something’s wrong, but its so hard to fight the tape.

I added SSL today and there are a bunch of pullback names that look interesting. I’ll be back in the morning if I add more new names.