Dow: +2112.98…

Nasdaq: +557.18… S&P: +209.93…

….bear market rallies are EXACTLY like what you saw today. This could see some legs for a little longer, so play it smart, play it small. There will be days ahead that will make you cry, so don’t guzzle too much of the Kool-Aid.

If you’re thinking V recovery back to the highs you’re in an alternate universe.

Possible targets for SPX could be 2472 (pretty close), then the 2650 area.

These rallies (first day anyway) happen strictly from short covering. Some of the worst fundamental companies had the best days today because they were the most highly shorted. See XLE, nothing changed but +16%. There were so many others.

You salty veterans know this, you youngins’ have no clue other than what they tell y’all in the “picture books.

This market in all likelihood will be truly bifurcated… the good stuff should rip over time… and the bad over-levered garbage might not ever come back.

Last night I wrote that the difference between now and the 2008-2009 crash was that we hadn’t seen any 10% rallies yet, but that they would be coming soon.

Well, we got a beauty today.

If you read this site every night you know that I’ve talked about the fact that we haven’t seen two up days in a row since the Age of Pericles, well tomorrow we’ll see if the bulls can make this stick.

Anyway, today we caught a +11.3% rally in the Dow, +9.3% SPX, +7.8% in the Nazzy, and +9.1% in the Russell 2000.

Today Trump said he wants to re-open the economy by Aril 12.

I never thought I would write those words.

Last night I wrote that I thought some politicians were starting to “maybe” float the idea of people getting back to work sooner. Get them out of their bubble wrap, dust them off and get them out there again.

Today, and I was surprised to read this, Governor Cuomo of NY said ” President Trump has an “understandable” point about the economy, says the US does not have to choose between economy and public health; the US could allow “lower risk” or “recovered/tested” individuals to return to work; says public health should always be a top priority.

If this rally wants to stick we are going to need more of this thinking.

Another “green shoot” from JPM today…

A V shape recovery is taking place in China for the 2Q. They are looking for 57% growth quarter on quarter after a 41% contraction in the first quarter. Active infections are at one-tenth peak levels and 80% of migrant workers have returned to work.

That seems way too optimistic to me but what do I know? Still better to see headlines like this than bad ones.

In the bad news department, Italy reported 743 new deaths from the coronavirus Tuesday, cutting short a positive two-day trend that had offered hope. Still, the Italian markets were very strong today.

My guess Italy is going towards peak virus, so we could see a blueprint now for the rest of Europe and the US.

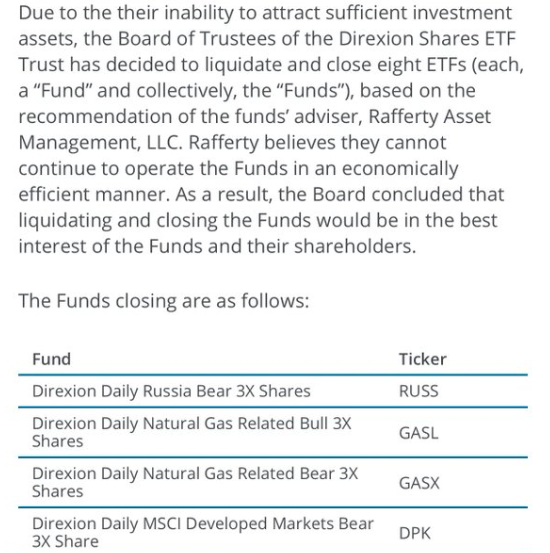

More bad news for energy etf’s especially of the3X leveraged variety.

The Fed has given a select group of massively leveraged hedge funds a de-factor bail-out via QE infinity and repo-liquidity, while middle class + small businesses wait for a lifeline. Too big to fail is now privatized, but the risk remains socialized.

The world is always changing.

How Wall St analysts will keep their jobs will be a mystery. For the foreseeable future, there will be zero earnings guidance from companies. Most analysts sucked when there was guidance anyway.

As the saying goes…you don’t need analysts in a good market and they’ll kill you in a bad one. Truer words were never spoken.

For all the Millenials that had a RobinHood account that blew up on you at least four times through this crash, bought TSLA at the top, and are now using coffee filters for toilet paper, all I can say is that it will get better.

I hope you’re all doing fine. see you tomorrow.