Dow: -1338.40…

Nasdaq: -344.94… S&P: -131.09…

It just keeps getting weirder. Today Bill Ackman basically came out and said we’re all gonna die.

After a cryptic series of tweets on his Twitter account, he evidently then went on TV and told the POTUS to shut down the country, completely shut it down for 30 days, or America, as we know it, will cease to exist.

Fun times. Heres the article.

It may seem hilarious, but that comment triggered an additional 1000 point DOW selloff and tripped the circuit breakers again. We halted trading for 15 minutes.

If the market bottomed today, will they call it the Ackman Bottom? The guy should be arrested for scaring the shit out of most of America today.

We’re in an alternative universe now and I had several out of body experiences today. Surreal has become an overused word, but it is.

A bunch of things happened today.

Most recently, after the close of trading, the NYSE said they will temporarily close the trading floor, and move to electronic trading because of coronavirus starting March 23.

No, it doesn’t mean they will close the stock market. I give a big LOL to this anyway because there really is no more “trading floor”. Its become more of a supper club for the dolts at CNBC and that bearded papaya with the rolled-up sleeves. Buy buy buy. That guy.

Many think the NYSE floor should have been closed years ago anyway, make it a museum. There’s no more action down there. It’s a joke.

Oil was down today about 17% to $22.50. Fill er’ up.

Ford and GM shut down all North American operations today.

I told you the other night that the government would ultimately end up buying stocks, not just treasuries.

Today Kulow said, “the government may take equity stakes for company aid”. Not sure yet if that means they put in a buy order like you and me or some other way, maybe a private deal.

It must be tough being a billionaire hedge fund manager during this crisis.

Today billionaire hedge funder Jeffrey Gundlach tweeted “As if we needed more evidence of a liquidity squeeze crushing asset prices, today I received panic offers of blue-chip (though not at all trophy) art at slashed prices.”

I’m sure many of you also got distressed calls for multi-million dollar pieces of art today.

Maybe Bill Ackman was the seller.

Getting back to the market, I must say that the market impressed me at the end. It first looked to me like it would get disemboweled and head to the lows for the day but it managed to hold key support, hence my sale of SDS. Not worth the overnight risk as SPX closed strong.

That December 2018 low was violated and it looked more pain was coming. It broke the low, roughly that 2346 level, traded down to a low of 2280, then reversed to close at 2398. That’s about 120 SPX points in 90 minutes.

These moves are insane, but the point is that it took back that very important support level and closed about 50 handles above it. That last 50 handle up move happened in 10 minutes, right into the close.

Of course, that level could be obliterated in about 16 hours, we’ll just have to see.

Remember when we talked about how the boat was almost tipping over in late February as call option buyers were neck-deep long? Everyone was all in? The phone booth was jammed. Then we crashed.

Right now, the 5-Day Moving Average Equity Put/Call Ratio is at its highest level ever, surpassing the prior record from November 2008. So right now they are loaded with puts, not calls. With data going back to 2003, there has never been as much fear as there is today in the options market.

You can decide if that’s a contrarian indicator or not.

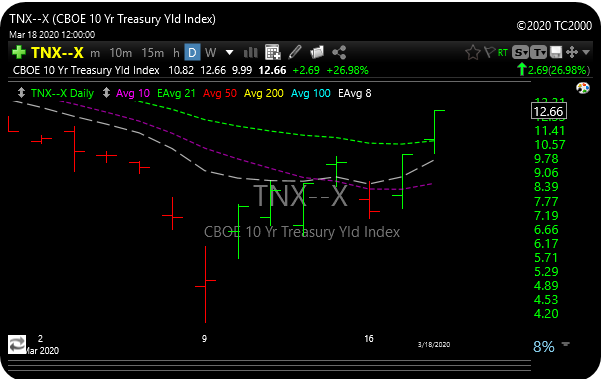

In other news, on the treasury front, yields rallied like a scalded monkey for the second straight day. Today the 10-year yield closed on the highs to yield 1.26%. Up 27.0% today.

Remember that just last week, the low intraday yield tagged 0.39%.

The corporate buyback blackout is in effect so the market will me missing much-needed support for stocks. The major banks have all already canceled stock buybacks that go beyond the normal buyback blackout period. I mean how can you take gazillions of dollars from the government and then turn around and buy back your own stock. It’s a bad look.