SPX +5.9%, DOW +5.1%, NDX +6.4%, Russell +5.0%, 10-year Treasury +36.9%.

For those of you folks that were with me back during the 2009 crash, you might remember that every time there was even the slightest piece of good news the phrase “green shoots” was invoked.

The pollyannas and the trapped and decimated longs at the time were grasping for anything that was perceived as good news, because there was none. Anything that wasn’t bad actually looked good.

Kinda like when your kid asks you the same question five different ways until they hope to get the answer they want.

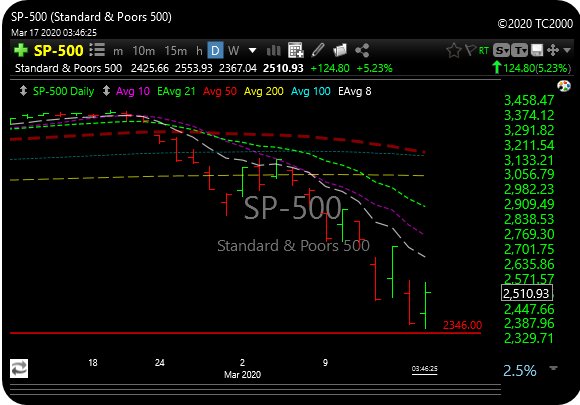

Today was a good day but I didn’t take the bait. How could you when we haven’t seen a follow-through day since…..February 11th. Yep, that was the last follow-through day and it was nominal at best.

See the chart below….show me two greens in a row since it got bad.

One “green shoot” was that my Defcon 1 level held today. That’s the Dec 26 SPX low that we’ve been talking about every day. Maybe that’s a start.

The other green shoot was Washington DC. They are taking out the kitchen sink to save the country. That helped, at least from a perception point of view.

Green shoot #3….They sold treasuries hard today, indicating risk on and a temporary flight back to the insanity known as the equity market. Look at that 10-year yield rip (+37.0%). It’s almost back to 1.0%. TLT got hammered.

Shoot #4- Semiconductors had their best day in a while. SMH was +8.5%.

Keep in mind though that the 13 largest 1-day rallies of the past 20 years all came within a bear market.

US Inflation Expectations (10-yr breakeven) fell to their lowest levels since January 2009: 0.73%. Unleaded gasoline futures broke below their 2008 lows today. The 22% decline was the largest 1-day ever.

The oil patch is a mess. Low 20’s coming I think.

We have $1.9 trillion in SPY options expiring on Friday. I’m sure it will be just another boring day on Wall St.

Sidenote…………………………….

Corporations have been purchasing $10b a day vs a 2019 daily avg of $4b of their own stock. However, the corporate buyback blackout period began yesterday and runs through 4/24. On average, we typically see a ~35% decrease in activity during the blackout. Not to mention the major US banks are suspending their buybacks to focus capital instead on providing lending support to the economy (if other companies adopt similar measures in sympathy this would obviously remove a huge area of support from the market).

This will start to hurt if we get another leg down, hopefully, support holds.

Have a great night.