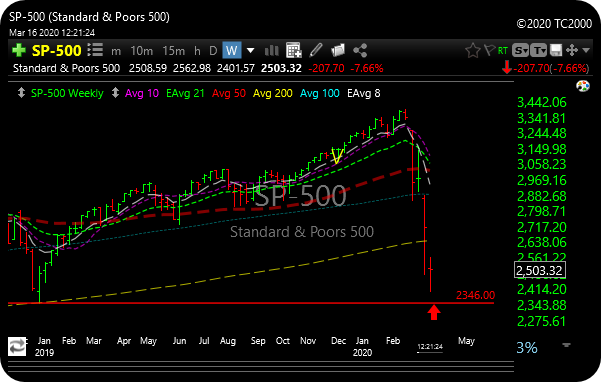

A couple of things. First of all, if you think the December 2018 lows will hold, then you can start thinking about a nibble. Not this second, but soon.

The closing SPX price on Dec 26 was 2,485. the intraday low that day was 2346.

We are currently, as of this writing, at 2531 and the low today was 2401.

So, although we broke the Dec 28 closing low already, we have not tagged the Dec 28 intraday low.

You get where I’m going. We are in “the zone” of support, if, in fact, this December 2018 level will decide to act as the ultimate support level for now.

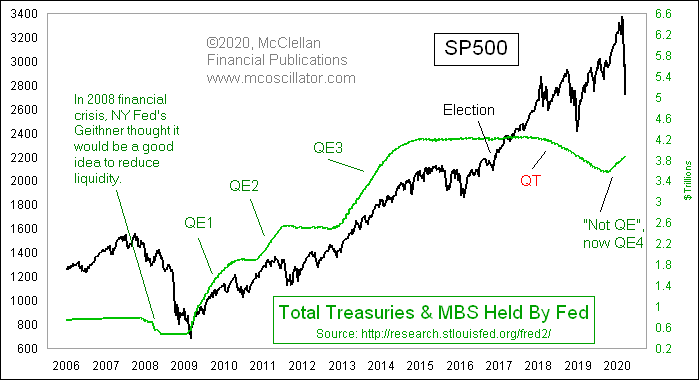

You know what the Fed has done. So far no one cares. But that could change.

When market players start looking around again for ways to spend their money, will they be looking at a 10-year treasury that pays them less than 1% or will they take a shot on stocks that will get them 3-4% here?

I mean AAPL and MSFT may suck right now, but are they going out of business?

You may detest the Fed and central bankers like me, and maybe this time is different, but check the chart below.

From Tom McClellan of McClellan Oscillator fame…

“We have been through 3 prior rounds of QE. Each time, it worked really well to lift the stock market. And it worked horribly whenever the Fed decided to stop. Now “Not QE” has morphed into QE4. Do you really want to bet against a phenomenon with this track record working?”

Look, the machines are in control right here, and things could get worse before they get better, but a lot is baked in.

No rush here, but it’s not the end of days.