“Moderation is a fatal thing. Nothing succeeds like excess.” Oscar Wilde

Treasuries

I guess I have to start off with the treasury market as rates drop precipitously into the bowels of hell.

The 10-year Treasury closed at a yield of 0.70% on Friday. Mind-boggling. The 30-year closed at a yield of 1.21% and the 30-year TIPS closed negative yield for the first time in history. If you waited to get a mortgage you are a genius, if you wait longer you are a real genius.

Here’s a 25-year chart of 10- year treasury yield.

As a result, TLT, which we often talk about, has exploded higher….especially on Friday as we saw a mammoth and historical breakout. When treasury etf’s trade like hot biotech stocks you have to scratch your head.

To give you an idea of how bad this is, Barclays is doing a 1 for 75 reverse split (that has to be a record) for its 3x Treasury Bear ETN (DBLS) which is down like 85% YTD and the NAV is down to like $1. Two other ETNs getting rev splits also. None of them have any assets.

Expect the “global easing” floodgates to open soon. The central planners can’t help themselves.

The Fed

The Fed sees no chance of a recession. Insists this rate move isn’t due to a financial crisis, yet they are still pumping $85B-$100B+ per day in repo(s), and just added $83B over the last week to their balance sheet. I’m sure everything is fine, kind of like when Bernanke said no recession, and we were neck-deep in one. Inept charlatans all.

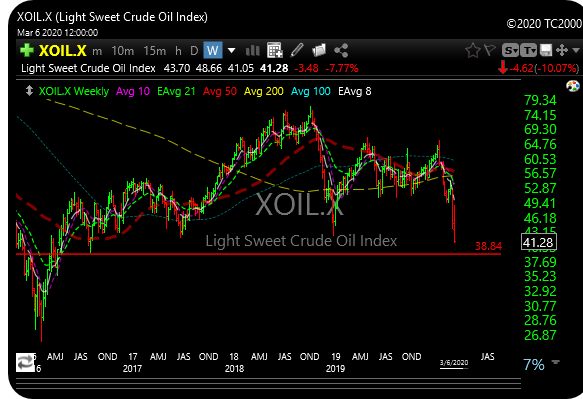

Oil

Oil got torched on Friday, down 10%. So cheaper prices are coming at the pump. Cheap pump prices are great, but it usually means that economic underpinnings are collapsing, so be careful what you wish for.

The price war and the race to the bottom begins.

The Saudi market cant survive plummeting oil. Aramco has huge problems. The ultimate oil flush is upon us, get ready for Monday. Visions of 2014. SCO should play much higher. $30 oil coming?

Shares in Saudi Arabian state oil giant Aramco fell sharply Sunday, after the state oil giant said it would slash the price it would charge customers for its oil.

Aramco timed their IPO perfectly. Wall St. made $600 million in fees for their efforts as they strategically jammed it down everyone’s throat. What else is new? Buyer beware.

Saudi Arabian oil company is down 9% currently.

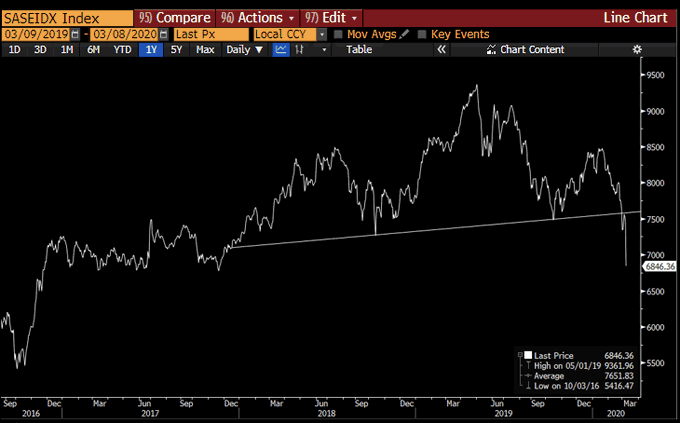

Saudi Arabia’s Tadawul index in full crash mode, down 8.5% right now.

Coronavirus

Italy has basically shut down most of Northern Italy over the weekend. That’s about 17 million people.

Cases are coming down in China, so maybe it’s getting contained over there, but cases are rising elsewhere.

Stocks and Stuff

- The S&P 500 has now declined 12.2% from its closing high 12 trading days ago. Year-to-date, the S&P 500 is down 8.0%.

- The Nasdaq dropped 1.9% Friday, is down 4.4% year-to-date, and down 12.6% from its closing high on February 19.

- The Dow fell 1% Friday and is down 12.4% from its closing high on February 12.

- The Russell 2000 dropped 2% today, is down 15% from its closing high on January 16.

The SPX each day last week: +4.6%, -2.8%, +4.2%, -3.5%, -1.7%.

So just looking at the numbers, with indices down 12% to 15% from their closing highs, this selloff is nothing special. But the volatility of it, the huge moves up and down over the past two weeks have jangled some nerves.

You read the post I sent out yesterday and why the market probably rallied late Friday Not sure that was an organic move ( more technical relating to the VIX), so I’m not sure if that rally will stick or not. I would like to have seen a full retest of the lows we saw two Fridays ago.

However, some sector etf’s did, in fact, break the Feb 28 lows on Friday.

They were: XLE (energy), XRT (retail), XLI (industrials), IYT (transports), and IGV (software).

As ugly as last week was though, the SPY actually closed slightly higher on the week.

With oil collapsing we could see a very negative stock market open as oil is a proxy for global growth, and right now it’s trading like growth has left the building.

Even crypto stocks are getting whacked. Bitcoin is currently down 9% in alternative universe trading.

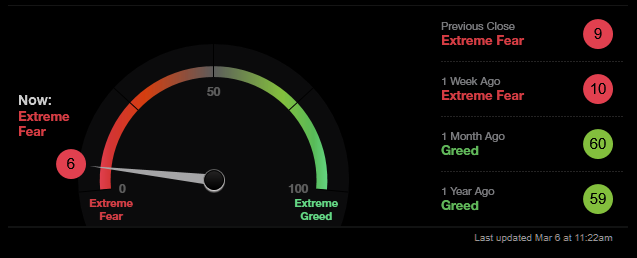

The “Fear-O-Meter” is back to extreme fear again. Remember that rallies happen on extreme fear, not greed. That meter cant go negative by the way.

Gold

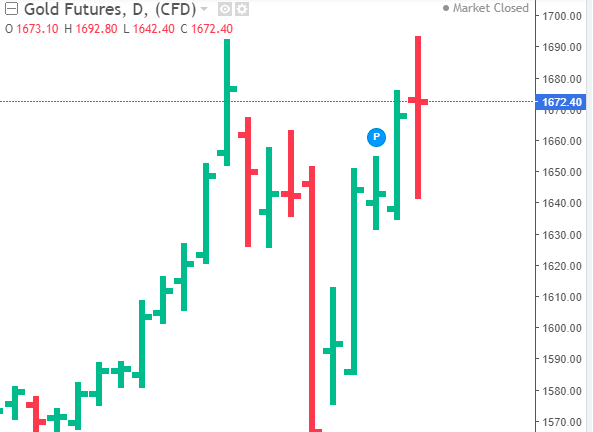

Friday was an odd day for the metals. Conventional wisdom would tell you that gold should have exploded to the upside as treasuries printed all-time highs and yields all-time lows. We also saw the greenback drop some more. This is the perfect cocktail for higher metal prices.

GLD (the etf) actually closed slightly green and physical gold also did, even though they were off the highs.

It’s possible that physical gold just hit resistance and backed off. Physical gold hit a perfect double top on its daily chart in pre-open trading on Friday. This is a natural spot to back off as nothing goes straight up.

The miners were getting hit hard, down over 3% at one point Friday but they managed to rally back. The miners also almost hit perfect Fibonacci resistance levels on Friday too, so a back-off isn’t that odd.

What to Do Now

I would relish a big gap down tomorrow because that would get things closer to extreme oversold levels again. If that happens, I will probably look to add some long exposure. Probably start off again with some leveraged long etf’s like UPRO, TQQQ, and DDM again. So the usual suspects. Stocks like AAPL and MSFT would be easy long-side trade candidates.

No longs or shorts today. Let’s regroup tomorrow. The coming week should be a hoot.