Dow: +330..6…

Nasdaq: +119.58… S&P: +27.07…

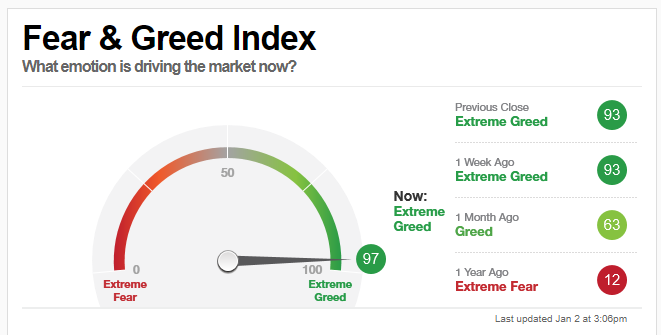

Every once in a while the fear & greed index pops up. What is it anyway?

It’s calculated on about seven indicators. I won’t get into detail on each but its basically……….

Stock price momentum, stock price strength, stock price breadth, put and call options, (bullish vs. bearish option volume), junk bond demand, market volatility (the VIX), and safe-haven demand (stocks vs. treasuries). Got it?

The reading is now at 97. What would people be saying if it was at 3? Back up the truck right? So 97 means…………….

They say buy fear and sell greed, but right now the pigs are at the trough-like a Golden Corral Thanksgiving buffet.

This doesn’t necessarily mean the market is about to implode in apocalyptic fashion. This condition could probably be corrected by a scenario where we just don’t go up every freakin’ day and consolidate gains. It could also be fixed with a 5-7% orderly pullback.

Apple rose 87% this year… but revenues were up only 2%. The Fed is flooding the markets with liquidity (you don’t always have to cut rates for a bullish market).

Semiconductors are getting goofy. For example, AMD is up about 200% since Dec. 2018. Its Revs to EBITA is approaching 100X and price to sales is currently 2.9X its dot com peak. (I’m sure it’s fine).

There was elevated action in the SMH January 140 puts today if that means anything. Probably some folks looking for a little pullback.

AMD Monthly Chart below going back to 2000. It usually ended badly up at these levels.

I guess the takeaway here is don’t chase and wait for better entries on pullbacks.

Many of the software stocks are trading 200 to 300X next year’s earnings. That’s a fat PE. One earnings miss going forward and the Street can be very unforgiving. Some will miss their numbers and the group will get hit.

Portfolio name ZYME broke out today (+4.7%) on good, not great volume, but I’ll take it.

Recently added FTCH also had a good day +7.3% and volume was excellent.

KODK looked like it wanted to do a retest back to our entry level around 3.80 after tagging 4.80 on Tuesday. The volume was big on the selloff today, but I didn’t see any news at all, so maybe it was just some serious profit-taking.

Tomorrow is the first Friday of the new year. How about that.