Dow: -162.77…

Nasdaq: -45.75… S&P: -22.10…

I guess those that have been making gobs of money in this market the last ten years off the easy money Fed actually expected the Fed to cut today? Is that why they took their bad and ball and ran home after selling things today? Such brats.

I don’t rule out a rate cut this year, the Fed overreached by raising rates in my opinion, but market players were looking for a much more dovish Fed today then they got, so they hit some bids at all-time highs. Nothing wrong with that.

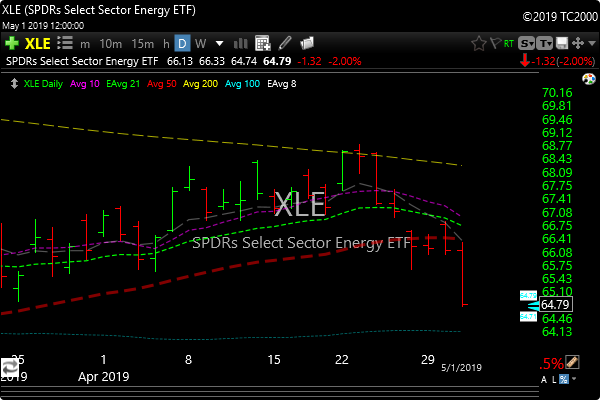

Oil went lower today and it took with it the energy stock space (XLE). XLE has not traded well lately and today it broke its bear flag lower along with lateral support after breaking it 50-day moving average in recent days.

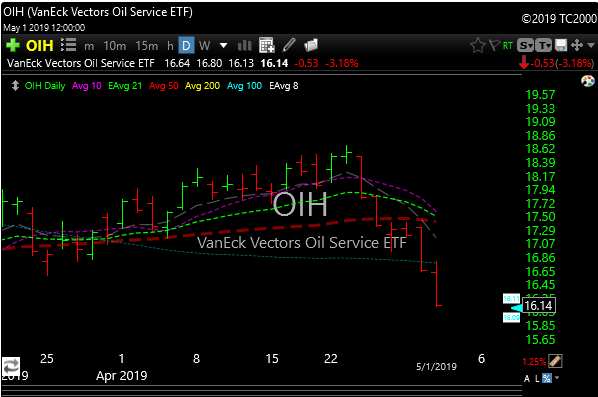

OIH-Oil Service

XME-Metals & Mining broke support today too.

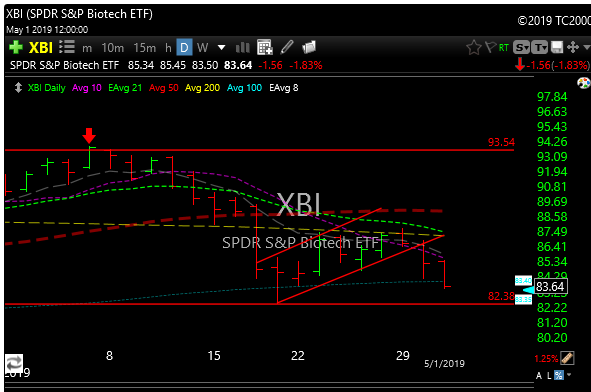

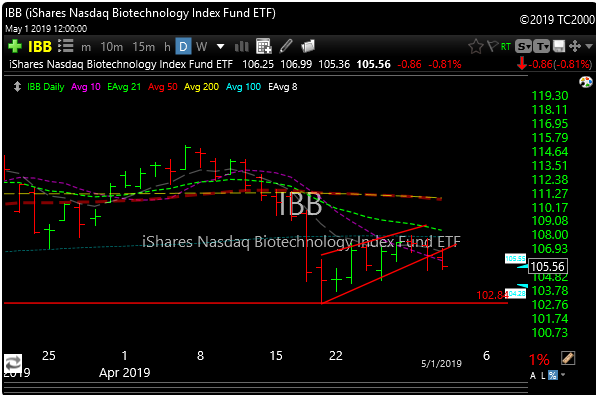

Those bear flags on IBB and XBI that I talked about in the video have snapped, resolving lower.

For what it’s worth, the LABD (short XBI) chart still looks pretty bullish to me.

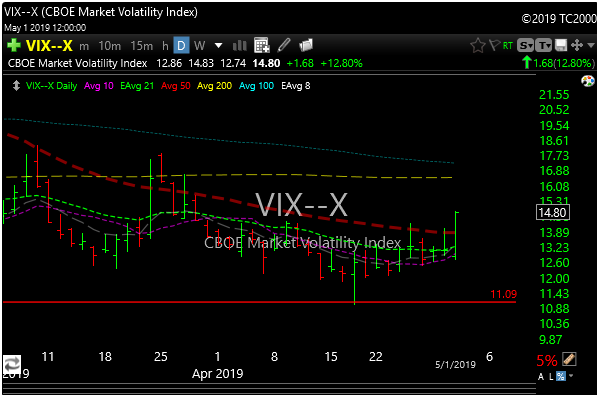

The sad and ignored VIX popped 12% today. Remember there is record short interest on this one.

But the Mona Lisa of them all, the NDX, broke that spectacular bull channel a little more today than yesterday after a failed attempt to retake it in the morning.

We got through the “Beware the Ides of March” thingy, so now we’ll see if the “Sell in May and Go Away” crowd starts yapping.

I’d love 5% down here so things set up better. Feels way too “chasey” here.

If anyone has interest my new ShortSide service, email me at [email protected]