Dow: -3.12…

Nasdaq: -4.15… S&P: -6.61…

U.S. stocks edged lower, dragged down by the latest slide in health-care and biotech. We highlighted these three sectors in the Sunday video. They looked iffy then and they look worse now. LABD is up 19% from Mondays open.

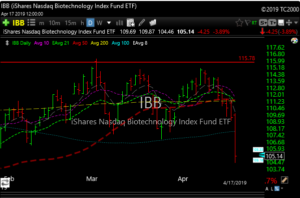

Here’s a look at the action in our two favorite biotech etf’s.

XBI broke its 50 and 200-day moving averages today. The volume was fairly enormous too, compared to what it’s been trading. Try 13.2 million shares today vs. a 90 day average of 5.3 million. Really ugly. Some February support comes in about a buck lower, that’s also its 100-day moving average.

IBB (-3.9%) lost its 100-day moving average today. It violated its 50 and 200-day ma last Friday. Volume was about 3.5 times the norm.

That action was coyote ugly, but to tell you the truth it didn’t really faze the Nazzy, SPX or Dow. However, the Russell 2000 was down 0.9%.

Major indexes have wobbled near peaks so far this week, hurt by the deepening rout in health-care stocks. Shares of insurers and drug companies have tumbled lately on fears that tighter regulations pushed by politicians on both sides of the aisle will crimp profits moving forward. So here is a look at XLV, the healthcare etf.

XLV (-2.9%)

So this has been a bloodbath, however, the positive takeaway is that this trip to the woodchipper has been confined to these sectors and hasn’t bled into anything else yet.

The semiconductor space (SMH) looks a tad overbought to me here. I would keep a close eye on that sector.

In other news, we finally stopped out on our last piece of RETA for +9.0%.

I also added a new long, TPNL at $8.00 today. Great chart. Great wedge breakout today on about 6X normal volume.