Friday was the most interesting day that we have had in quite a while. It’s the kind of day that keeps you honest, it temporarily corrects your complacency and makes you sit up straight. It felt like someone rang a bell and the selling began at a ferocious pace. All the hedgies and institutions that have been trading all the same names had their comeuppance.

We have talked about how market breadth has been lacking and how dollars seem to have been chasing several names: GOOGL NFLX FB AMZN and AAPL

Trees don’t grow to the sky forever, but these performance chasing folks thought so. This is what happens when things get stretched, maybe even a little parabolic.

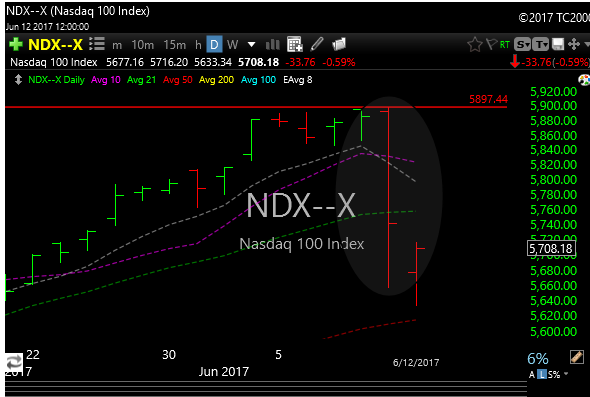

The Nasdaq was the culprit on Friday, it felt like someone rang a bell and the selling began at a ferocious pace. $GOOGL, $AMZN, $NFLX and $AAPL immediately saw their bottoms just drop out and cascade lower. The Nazzy did manage a little dip buying in the last hour on Friday, but today, Friday’s lows were violated in the morning before more dip nibblers showed up.

What is interesting to note is that the Dow was green on Friday and the S&P suffered negligible damage. This was mostly technology, not even biotech that much.

The crazy people from the tech bubble in 2000 are back saying the same thing is going to happen. I beg to differ, this was a pullback based on short term irrational exuberance. It needed to happen.

Energy is starting to act a bit better, but I’m still not a believer until $XLE can cross above, and close above, this vicious down channel. There could be some money to make here, but not yet, and I don’t see a catalyst for higher oil right now.

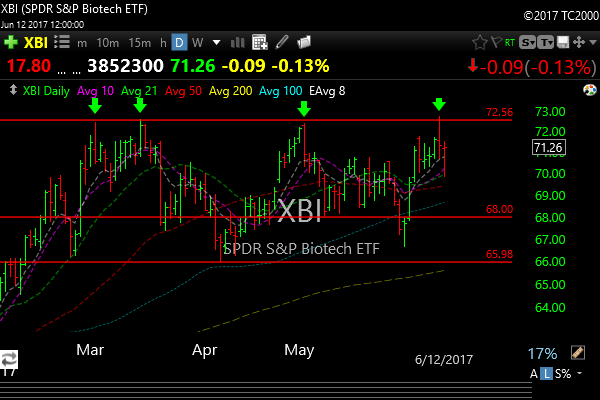

My favorite sector, biotech, was at a critical point on Friday, but it failed to break above quadruple top resistance. It’s still fine though and it rallied nicely off today’s lows.

NEW ADDITION

Today I added PCMI as a new short to the P&L at 19.30. This is a very bearish pattern with targets of 18 then 16.