I will have video out tomorrow. We have a pretty full dance card right now on the P&L, but that doesn’t mean I’m not looking for more set-ups.

Football is over, I can’t watch basketball, golf is OK to watch and the dulcet tone of Jim Nantz’s voice isn’t bad if you want to catch a Sunday nap. Pitchers and catchers are throwing it around in spring training, but first pitch isn’t until April 1 so it’s boring out there for now.

The market is hot and the “livin’ is easy” right now, so it’s a good time to take a breath, manage what you have, and allocate your capital to things that are working, and to sell or trim things that arent. Don’t fall in love with anything in this market. Own what will reward you, don’t give stocks time to work. If they aren’t working now, then they may never.

Right now, steel, biotech, and metals & mining (CLF, RIO) type names continue to act well.

Consumer discretionary (XLY) is at all time highs and believe it or not still looks higher, because the technicals aren’t overbought.

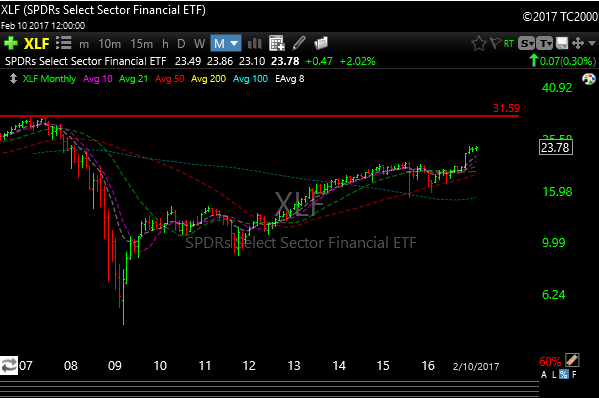

The financials (XLF) is probably the only sector that isn’t at all time highs yet. XLF still has a way to go to tag those 2007 highs. Notice the bull flag on the monthly chart. Sure looks higher to me. When that move continues, it will further lift all boats.

Biotech continues to be in breakout mode.

See you in the morning.

Joe