Dow: +15.54…

Nasdaq: -7.77… S&P: +2.44…

Rising bond yields and a strengthening dollar remained focal points in today’s action as the market looked to substantiate their rate hike outlook with the minutes from the FOMC’s September 20-21 meeting.

Bond yields and the greenback rose through the first half of the day as a solidifying rate hike outlook provided support. Market participants continued to discount the possibility of a November rate hike while betting on a policy shift at the December meeting. Right now a rate hike at the November meeting is just 9.3% while the probability of a hike at the December meeting sits at 69.9%.

If the market starts to believe that a rate hike this year is becoming “less” likely, then expect rallies in utilities, staples and real estate reit’s.

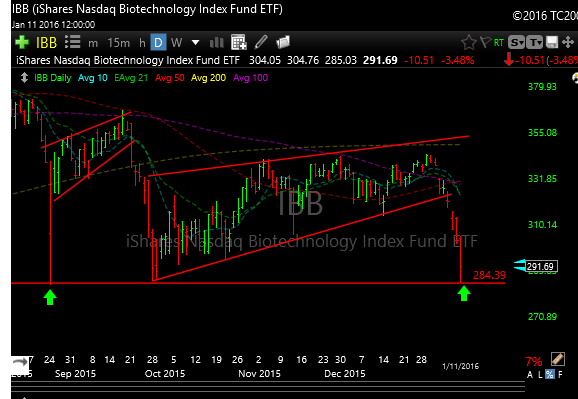

Biotechnology underperformed once again in the health care sector, evidenced by the 2.5% decline in the IBB -6.87, which closed below its 200-day moving average — a move that will be regarded as a negative technical development.