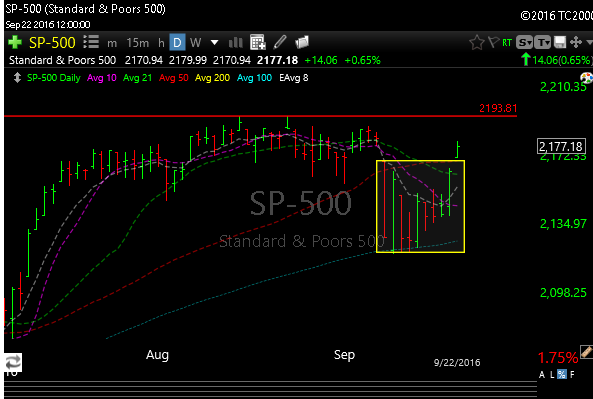

Dow: +98.76…

Nasdaq: +44.34… S&P: +14.06.

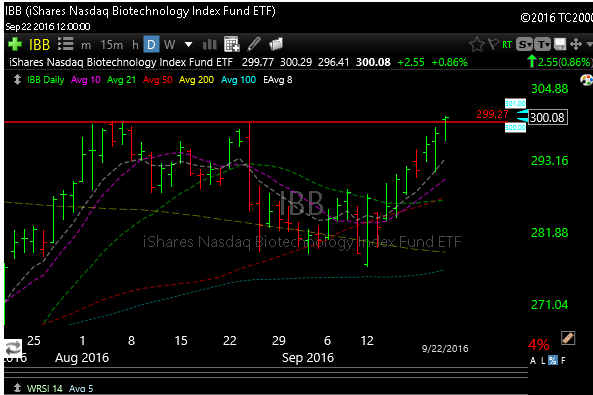

The IBB finally poked above and closed above that lateral resistance we’ve been watching. It could have broken out in a more convincing fashion, but I guess I’ll take it.

A couple of things are behind us now, the Fed and the BOJ. Yellen doesn’t seem to want to ever raise rates until here scenario is perfect. Nothing is ever perfect and she will eventually find that out the hard way.

The Bank of Japan I think has finally come to the realization that their QE hasn’t worked and isn’t working or they would have done something yesterday. They’re firing blanks at this point and they know it. Europe is built on sand too, and they will be back on the front page at some point soon.

This will all come home to roost soon. The key is to make some hay while the sun is shining, be aware and be ready. The whole system is broken and when the first guy blinks the selloff will be epic.

For now though, the bulls are in charge and the bears get whacked at every turn. The next seven days should have a bullish bent because the market is starting to rally again, and those dopey hedge funds and portfolio managers will chase whatever moves in order to print some good performance for the third quarter.

Biotech has been moving, so that should continue, barring an unforeseen event. They always chase whats moving as the end of the quarter approaches. Fund performance is still sucking wind, so window dressing should continue. Buy the winners.