Dow +120.74 at 18347.67, Nasdaq +34.18 at 5022.82, S&P+14.98 at 2152.14

Stocks began the day on a higher note, responding to a continued rebound in overseas markets. Japan’s Nikkei (+2.5%) paced the rebound after Prime Minister Shinzo Abe announced a potential stimulus package could total JPY10 trillion, ( that’s with a T). Separately, the Bank of England’s added to stimulus speculation when he stated that a monetary response remains available should Britain’s post-Brexit outlook worsen. The Bank of England is scheduled to meet this Thursday. Of course they are going to join Japan.

As a result of all this financial engineering, stocks ripped higher again and treasuries started to really get hit. The selloff in bonds started yesterday and followed lower today.

Commodities also did well with the exception of gold, silver and the miners. Their move has been parabolic so a selloff was due.

Other commodities like steel and coal did well and energy stocks moved higher too as crude rebounded. Oil inventory # is tomorrow.

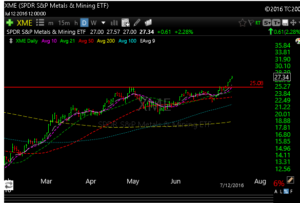

The XME exploded to more new highs today too. The move in the sector has been amazing to say the least.

I added 3 new longs today with AQMS, BEAT and YRD. I sold the balance of CLF for +30% and took stops on ERY and SCO.

One interesting note here as some are calling for the top in bonds now. If bonds do get sold and the proceeds go to stocks we could be in for a pretty nice melt up going forward.

Keep in mind we have seen a selloff in bonds before when the central bankers got crazy like they did this week, only to see a head fake.

I could make a case either way on interest rates, so the best thing to do is probably just let the market tells us what it is going to do rather than opine.

If you have been wondering though who has been bidding up stocks over the last couple of months, especially when we have seen pretty consistent outflows in equity mutual funds, look no further than this piece from Zerohedge. Always a fun read. These guys have been calling for the Apocalypse since 2009, but they do some really good work and its worth the read. I would love to know your thoughts.

Bottom line for now is that the market is in momentum mode and the wind is at its back. The next big event for the S&P is if the futures can get above and close at that 2150-2155 level. If it can, 2200-2300 is certainly in the cards, with 2400 being a blow off top type target.

See you in the morning.