I guess you could just watch my Sunday video or just read last nights post if you want to get a handle on things, because not much has changed. Just a little more of the same.

We were flat to slightly down today on the indexes, but the action was bad and weak patterns got weaker.

European banks are in liquidation mode right now and of the big four that I follow, CS, DB, SAN and BCS, only the latter hasn’t take out its April lows. The rest have gone through like a hot knife through butter.

The SPX rallied back today, but it still closed red and under the 50 day moving average.

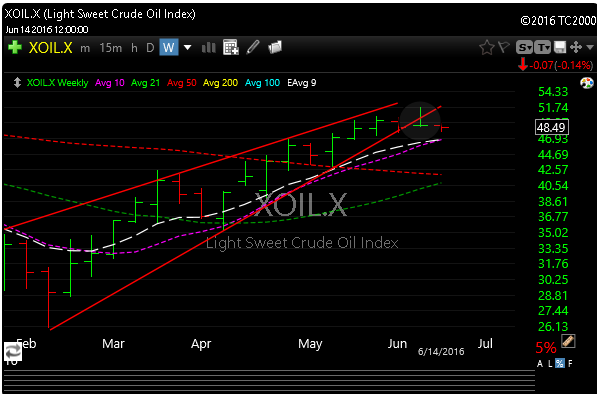

Oil is interesting here, but so much depends on rates and the dollar. Based on that gravestone doji (above, small circle) last week it should go lower. We’ll just have to see. I don’t see a move to 45 being a big deal here based on where its come from. It also broke an uptrend last week that was in place since January.

Oil-Weekly chart

It’s still all about the fear and uncertainty about the ramifications of a Brexit. Today, the Sun newspaper, a major London paper called for the Brexit and said it will happen. This is interesting because this paper has called every election correctly over the last 40 years. The London bookies still give a slight edge to a Brexit. The Brexit vote is June 23. European politicos are scrambling like headless chickens right about now and I can only imagine the backdoor deals that are being bandied about.

It always makes me nervous when equity prices are rising, but the Volatility Index ($VIX) shows increasing fear. Why? Because typically the market becomes complacent (lower VIX) as the S&P 500 moves higher. Last week, I wrote about whether the rising VIX (in a rising S&P 500 environment) was sending us a warning signal. We’re now getting our answer. Large losses in stocks do NOT occur without the VIX rising significantly.

Anyway, some shorts are starting to act better here and even though energy has pulled back, its done so on light volume and the charts actually look constructive and are overall still bullish.

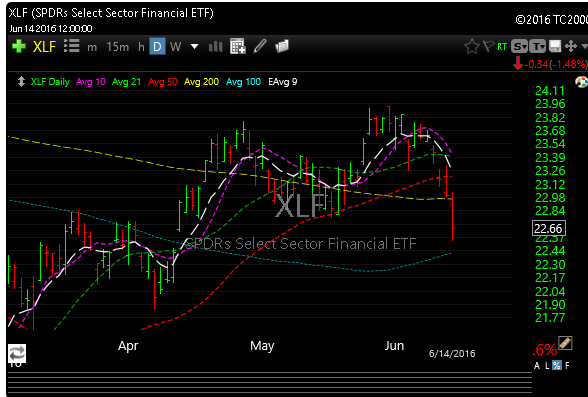

Finanicials continue to be a train wreck here, and although the market wasn’t all that bad today, they sold off hard. I’ve been telling you to stay away from the banks for a year and nothings changed. Stay away. There will be better places to put your money this year.

Our favorite lawn gnome, Janet Yellen, gets the microphone tomorrow and I’ll be wearing my Kevlar propeller hat to work.

See you in the morning.