The past week saw the S&P 500 notch a fresh high for the year before registering its second consecutive weekly gain. The index added 0.5% for the week while the Nasdaq underperformed, shedding 0.7%.

We didn’t receive any market-moving data during the past week, which kept the Atlanta Fed’s GDPNow forecast for the first quarter unchanged at 0.3%. The advance estimate of first-quarter GDP will be reported on Thursday at 8:30 ET, a day after the Federal Open Market Committee announces its latest policy decision.

The Fed meeting will be the highlight of next week, but the fed funds futures market remains convinced that there is just a 1.0% chance of a rate hike being announced on Wednesday.

The Dow and S&P each came within 2% of those all-time highs this week, but a drop in utilities and telecom—the two best-performing sectors in the S&P over the past 12 months—dragged indexes lower. Consumer staples also started to dive bomb.

The Dow is hovering near 18000, up 3.3% in 2016, but the market struggling to find impetus during a lackluster earnings season.

MSFT was biggest laggard in the Dow. Its shares tumbled $4, or 7.2%, to 51.78 today, while shares of GOOGL dropped 42.23, or 5.4% to 737.77 Both companies released earnings late Thursday and fell short.

Japan’s Nikkei Average ended 1.2% higher to its highest close since Feb. 2, with exporters boosted by a drop in the yen against the U.S. dollar, following hopes of fresh stimulus from the Bank of Japan.

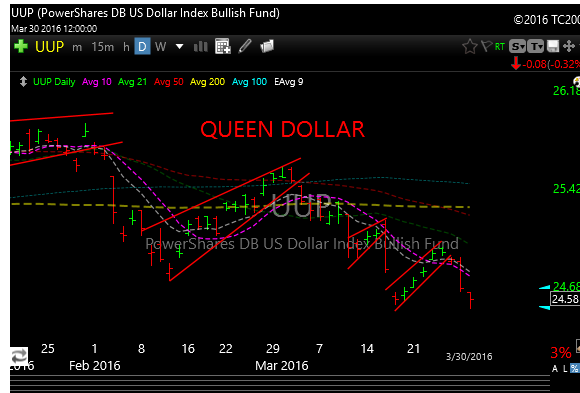

The U.S.Dollar will be interesting to watch next week. As you can see below it is off its lows and starting to rally. A sustained move higher can upset the apple cart as oil and energy could come under pressure. Also multinational earnings suffer with a stronger dollar.

Become a member