The quarter is over and we start anew. Sometimes you need a clean slate, I feel like I do this quarter. January and part of February were excellent, but I stayed too long at the well on the short side. This occasionally happens and all you can do is press on. If you are a casual observer of the market, then you saw that nothing really happened in the first quarter, as we are flat for the year just about. But what a roller coaster it was.

A rebound in oil prices, easy money and better-than-expected U.S. economic data left major indexes with gains for the quarter despite losses from the first six weeks of the year, when stocks fell sharply amid concerns about the global economy and an unclear course for the world’s central banks. We went from the Apocalypse to the Fields of Ambrosia all in a few weeks.

Was the rally off the Feb. lows just a vicious rally in a bear market, or are we OK? It doesn’t really matter. Things just get overbought and oversold.

How will the market react to lousy first quarter earnings?

First-quarter earnings for S&P 500 companies are forecast to slump 8.5% from the same period last year, according to FactSet. That would seal the index’s first four-quarter streak of declines since the financial crisis. Analysts don’t expect quarterly earnings to rise until the second half of the year.

Its not like the market doesn’t know this already and stocks are proceeding to the highs with this knowledge anyway, so it will be very interesting to see if we can rally higher off lousy numbers in the coming weeks.

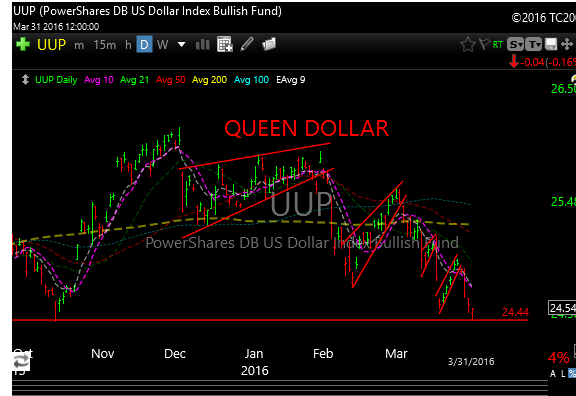

I think one of the most important things to watch over the next week or two or three is the Dollar. As you can see in the chart below it bounced off October support today. If the dollar were to break that support it will be a boon to commodities of all types, oil, gold and the miners. However, if the dollar does decide to rally higher it will create a mess in commodities and energy. It also puts pressure on the earnings of S&P 500 companies that have big multi national exposure, and most do. Yellen is petrified of a strong dollar for these reasons, hence her dovish stance. In my humble opinion, she is much more worried about the dollar than a couple of upticks in interest rates.

See you in the morning.