The Dow lost 79.98 points, or 0.5%, to 17502.59. The S&P fell 13.09, or 0.6%, to 2036.71—dropping back into negative territory for the year—and the Nasdaq lost 52.80, or 1.1%.

Energy stocks led the S&P lower, falling 2.1% as oil prices fell. U.S. crude oil tumbled 4% to $39.79 a barrel as U.S. as data confirmed a huge rise in crude stockpiles.

Volume today was probably the lowest of the year. The market seems exhausted from the rally right now, hence the slow sideways action. The size of daily swings has diminished in recent sessions. The S&P moved less than 1% for the eighth session in a row today, its longest such streak since August.

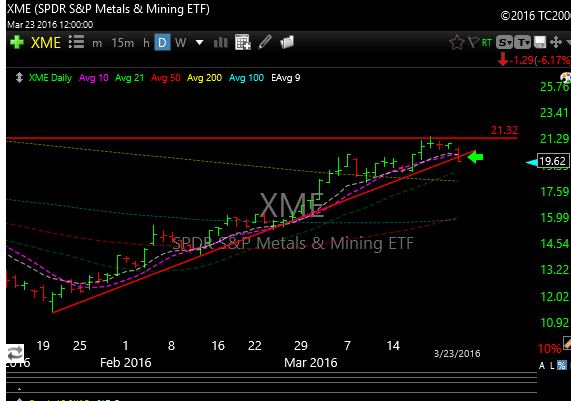

Of interest today was the weakness in gold mining and metals and mining. After a big rally off the lows, the XME has hit resistance and has been rejected. Today the etf was down over 6% and broke an uptrend line that has been in place for three months. Bottom line, commodities of all shapes and sizes looked horrible today.

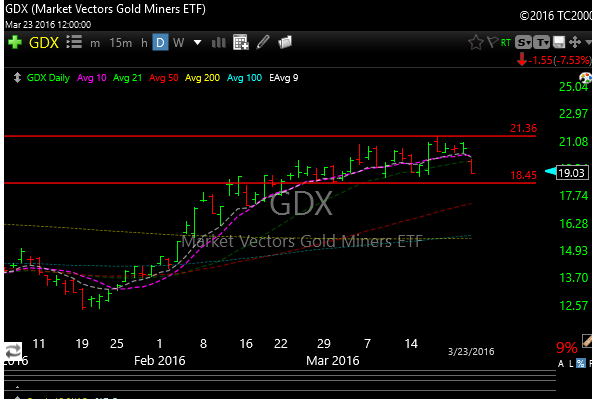

Also GDX got hit.

The market is closed Friday and its a light data weak, but to me the market looks tired. The bulls need to retake the hill so to speak, or the bears could feel empowered to start hitting bids again.

After a promising couple of days, profits were taken today in biotech. (IBB).

See you in the morning.