Major indexes drifted higher Monday in a quiet trading session. Investors declined to make big bets at the start of a holiday-shortened trading week, cooling the weeks long resurgence in stocks.

I don’t expect any wild directional changes for stocks this week. Earnings season is essentially over, there are few significant economic data releases and many stock markets around the globe are closed on Friday in observance of the Good Friday holiday. You never knw though what they can pull off in what is viewed a s slow trading week.

There is no real fear out there for now, but a lot of complacency, as the VIX is trading at a 7 month low.

Crude oil continued to rise, gaining 1.2% to $39.91 a barrel today.

While commodities prices have stabilized in the past few weeks and economic data have improved, equity markets remain sensitive to fluctuations in the oil price if volatility returns.

Technically, crude is at lateral resistance and the 200 day moving average.

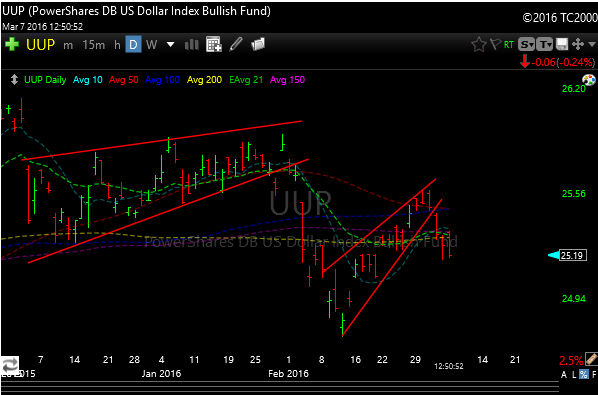

The dollar (UUP) has lifted for two days in a row, but for now it just looks like dead cat bounce.

In last nights video I mentioned biotech and the possibility of a short term bottom in the sector. IBB had a decent, not great day, but it seems to be showing some tendencies of a possible bottom. We’ll see, still early. I added BIB today which is the 2X long etf.

See you in the morning.